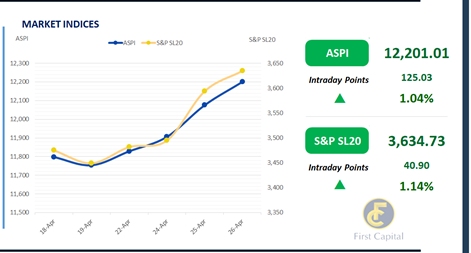

The market maintained its upward trajectory for the 4th consecutive day, with active participation from retail and high-net worth investors driving the ASPI to close at 12,201, marking a gain of 125 points and signaling a bullish market trend.

Notably, Banking sector counters such as COMB, HNB along with mid-cap companies such as SPEN, BIL and CFIN contributed to the ASPI positively while the negative contribution from some index-heavy weights was also observed.

However, the daily turnover stood at LKR 4.0Bn, marking a steep 71.4% incline from the monthly average of LKR 2.4Bn with volumes majorly coming through LOLC cluster.

Capital Goods sector dominated the turnover with 36%, while Food, Beverage and Tobacco and Diversified Financials sectors jointly contributed 33%.

Investor sentiment toward Banking and Hotel sector counters remained optimistic, fueled by expectations of forthcoming earnings releases. Foreign investors remained net sellers recording a net outflow of LKR 288.3Mn.

Yield curve nudges down as buying appetite picks up

The Secondary market yield curve narrowly edged down after today’s session as buying interest extended in the market for the second consecutive day with investors gradually gaining confidence on the macro front.

On the short end 2026 maturities, 15.05.2026, 01.06.2026, 01.08.2026 and 15.12.2026 hovered between 11.05%-11.25%. Also 01.05.2027 and 15.09.2027 recorded transactions between 11.75%-11.60%.

On the belly of the curve, 2028 maturities; 15.03.2028, 01.05.2028, 01.07.2028 and 15.12.2028 hovered between 12.15%-11.95%. Activities showcased a gentle pick up as volumes recorded at moderate levels. On the external side LKR continued to appreciate against the greenback, closing at LKR 297.2. Meanwhile, overnight liquidity closed positively at LKR 169.3Bn whilst CBSL Holdings remained stagnant.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..