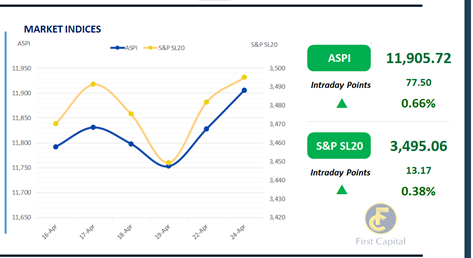

The bourse began the day on a bullish note, driven by enthusiastic participation from retail investors, resulting in the market reaching an intraday high of 12,050 before closing at 11,905, marking a gain of 77 points.

Despite the prevailing uncertainties, trading activity showed signs of recovery on the second trading day of the week with increased interest observed on the index heavyweights such as HAYL and LOLC, whilst improved activities were also seen on the mid-cap entities such as BIL and CARG.

However, slight selling pressure continued to be visible on the banking sector shares, notably on SAMP, NTB, and NDB. Daily turnover slightly increased to LKR 2.5Bn, up 7.9% from the monthly average of LKR 2.3Bn.

The Food, Beverage, and Tobacco sector led turnover at 27%, while Diversified Financials and Capital Goods sectors jointly contributed 37% to turnover. Foreign investors turned net sellers, with a net outflow of LKR 5.7Mn.

LKR 92.0Bn Bill auction fully accepted, with all maturities accepted after 11 auctions

The secondary bond market continued to witness thin volumes and limited activities for yet another day, with activities largely centered on the belly-end of the curve. Few trades took place prior to the CBSL auction, with 01.06.26 trading at 11.15%, 01.08.26 trading at 11.14%, 15.12.26 trading at 11.34%, 01.05.27 trading at 11.80%, 15.09.27 trading at 11.90% whilst 15.03.28 and 01.07.28 maturities traded at 12.15% and 12.20% respectively. Furthermore, positive buying interest was observed on the LKR 92.0Bn bill auction held today, with CBSL fully accepting all offered across all tenures (since 31-Jan-24). CBSL accepted LKR 35.0Bn for the 91-day bill at 9.90% (-13bps) whilst LKR 30.0Bn and LKR 27.0Bn were accepted from the 182-day and 364-day maturities at 10.08% (-14Bps) and 10.21% (-02Bps), respectively.

Furthermore, CBSL also announced the LKR 100.0Bn treasury bond auction, which is scheduled for 29th April 2024, in which CBSL is planning to raise LKR 25.0Bn from the 15.03.28 maturity whilst LKR 30.0Bn and LKR 45.0Bn are expected to be raised from 15.05.30 and 01.10.32 maturities. Meanwhile, as per the CBSL published data, Sri Lankan Rupee bounced back and appreciated to LKR 301.46 against the US Dollar, after recording 5 consecutive days of depreciation.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..