Commencing the week, ASPI regressed to red as panic selling lingered mainly on EXPO following the release of the 3QFY23 results. In which, earnings fell both on a QoQ and YoY basis by 66.7% and 87.0%, respectively and recorded at LKR 3.0Bn amidst the significant contraction in the global freight rates which almost fell to the pre-pandemic level.

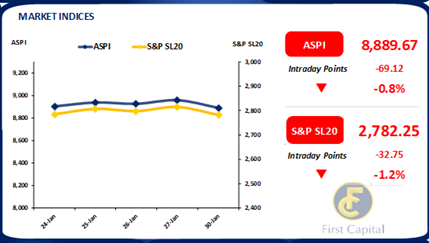

Accordingly, index tumbled lower reaching an intraday low of 8,814 as soon as the market opened and gradually rebounded as investor interest reactivated on index heavyweights. Thereafter, market traded on a flat note to close the day at 8,890, losing 69 points.

Despite an improvement in the market activity, turnover fell to LKR 1.7Bn compared to the previous session and remained below -8% cf. monthly average turnover of LKR 1.8Bn. Diversified Financials sector led the market turnover with a contribution of 23%, while Capital Goods, Transportation and Insurance sectors contributed 15% each.

Primary bond auction partially filled

CBSL conducted its 2nd primary bond auction for LKR 70.0Bn today and partially accepted LKR 67.9Bn, of which LKR 55.0Bn was accepted from the 01.05.2027 maturity at a weighted average yield of 29.21%.

Moreover, despite the interest from investors on 01.07.2025 maturity, CBSL accepted LKR 12.9Bn (from LKR 15.0Bn offered) at a weighted average yield of 32.19%. Meanwhile, secondary market remained on a standstill during today’s trading session.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..