After 7 consecutive sessions of gains, the broad market experienced downtrend movement as investors booked profits primarily in the Banking sector counters and blue-chip firms.

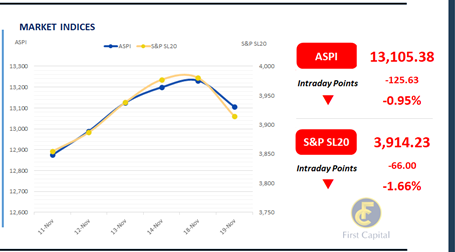

The ASPI closed the session in red at 13,105, losing 126 points, marking a 1.0% decrease from the previous day. Despite this, investors maintained a positive sentiment towards the Hotel sector counters, with a surge of interest in SERV, KHL and MARA emerging in the market.

JKH, HNB, SAMP, COMB, and NDB emerged as the top negative contributors to the index. In contrast to previous sessions, the market saw a decrease in participation from HNW investors.

Accordingly, turnover stood at LKR 6.0Bn, marking a 66.5% decrease from the monthly average. Moreover, the Capital Goods sector led the turnover by 55%, followed by the Banking, and Food, Beverage & Tobacco sectors jointly contributing 27% of the overall turnover. Foreign investors remained net sellers with a net outflow of LKR 772.5Mn.

Profit chase unfolds pre T-bill auction

The secondary bond market yield curve experienced a slight upward shift from the previous day, influenced by marginal profit-taking activities ahead of the LKR 145.0Bn T-bill auction scheduled for tomorrow.

Trading was predominantly focused on the belly-end of the curve, with notable activity across the 3-5Yr tenors. Key trades included 2027 maturities, such as the 15.09.27 and 15.12.27, which closed trades at 10.95% and 11.00%, respectively.

Similarly, 2028 maturities, including 01.02.28 and 01.05.28, recorded trades at 11.20% and 11.25%, respectively, while the 2029 maturity, 15.09.29, traded at 11.53% during the day.

The AWPR for the week ending 13th Nov-24 declined by 5bps, registering at 9.11% compared to the previous week’s closing of 9.16%. Moreover, foreign holdings in government securities marginally increased by 0.1%WoW, registering at LKR 54.8Bn as of 13th Nov-24.

Consequently, the foreign holding percentage remained stagnant at 0.3% over the week. Meanwhile, the overnight liquidity for the day was recorded at LKR 64.7Bn, whilst CBSL holdings remained stagnant at LKR 2,515.6Bn.

Furthermore, in the forex market, the LKR continued to slightly appreciate against the USD for the 3rd consecutive session, closing at LKR 291.6 for the day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..