Colombo stock market rallied for the third consecutive day supported by the recovery in corporate earnings and the continuous decline in interest rates at the weekly T-Bill auction.

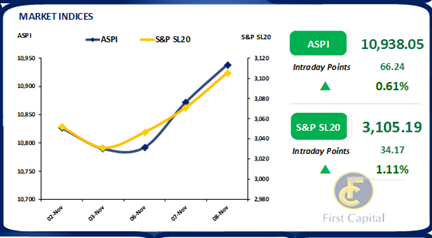

Accordingly, investor activity was mainly centered on the Banking sector which drove the market. Hence, index started off on a solid footing and maintained its steep upward trajectory, reaching an intraday high of 11,020 before closing the day at a 1-month high of 10,938, gaining 66 points.

Moreover, buoyed sentiment on MELS extended for yet another day, which positively backed the index following the announcement of the first interim dividend of LKR 4.27 per share.

On the other hand, JKH observed notable collections from both retail and foreign investors, with the latter recording a net foreign purchase of LKR 151.8Mn for the day.

As a result, turnover was recorded at a healthy level of LKR 1.8Bn (+95% compared to the monthly average turnover of LKR 936.0Mn), primarily driven by Capital Goods (41%) and Banking sectors (21%).

Yields at the auction pare down across the board

CBSL conducted its weekly T-Bill auction today, expecting to raise LKR 165.0Bn, but however the auction was slightly undersubscribed despite 03M and 06M gaining an over subscription while 1Yr bill only enticed an acceptance of LKR 2.4Bn out of the total offered LKR 30.0Bn.

Moreover, weighted average yield rates pared-down on a moderate level with 03M maturity closing at 15.64% (-29bps) and 06M closing at 14.81% (-12bps). However, 1Yr bill declined marginally by only 3bps to and 12.99%.

Meanwhile, activities took a subdued note in the secondary market with limited trades witnessed on 15.05.2026 which traded at 15.17%. CBSL also has announced a T-Bond auction worth LKR 250.0Bn which is scheduled to take place on 13th Nov-23.

Accordingly, LKR 60.0Bn is to be raised from 15.01.2027 maturity while LKR 110.0Bn and LKR 80.0Bn are expected to be raised from 15.03.2028 and 15.03.2031 maturities, respectively. On the external side, LKR slightly appreciated against the USD as it closed at LKR 327.1.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..