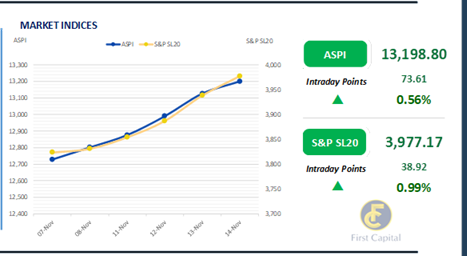

A mixed bag of quarterly results swayed investors, leading to mixed sentiment during the short trading day as Colombo Bourse experienced a relatively volatile trading session with ASPI soaring to 13,199, gaining 74 points.

Retail favorites such as BIL, along with Banking sector counters like SAMP, COMB, NTB and PABC, took the center stage following their commendable quarterly results.

Meanwhile, on the back of stable participation from HNW and retail investors, turnover stood at LKR 3.8Bn, marking a 16.5% increase from the monthly average standing at LKR 3.3Bn.

Moreover, the Banking sector led the turnover by 43%, followed by the Food, Beverage & Tobacco and Capital Goods sectors jointly contributing 34% of the overall turnover. Foreign investors remained net sellers with a net outflow of LKR 155.5Mn.

Market halts in election results anticipation

Following a sustained period of bullish sentiment, the secondary market yield curve remained broadly stable while generating ultra-thin volumes.

Investors largely refrained from taking significant positions, opting to await greater clarity on the upcoming parliamentary election results.

Amidst the thin trading activity, limited transactions observed across mid-tenor maturities. Notably, the 15.01.28 traded at 11.25% while 15.09.29 changed hands at 11.60%.

Meanwhile, the CBSL has announced a Treasury Bill issuance totaling LKR 145.0Bn through an auction scheduled for 20th Nov 2024, out of the total auction, LKR 50.0Bn is to be raised from 91-day maturity, LKR 65.0Bn is expected to be raised from 182-day maturity while LKR 30Bn is to be raised from 364-day maturity.

On the external side, the LKR further appreciated against the greenback closing at LKR 292.3. This movement mirrored broader trends as the LKR also appreciated against other major currencies such as the AUD, GBP, and EUR.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..