The broader market moved up in the early session then gradually drifted lower and moved sideways for most of the day.

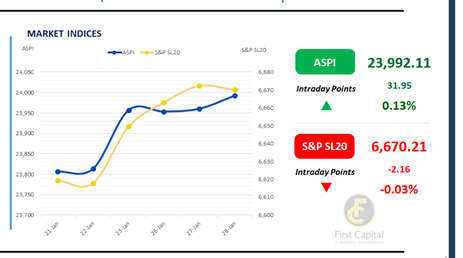

ASPI gained 32 points to close at 23,992. S&P SL20 dropped by 2 points to close at 6,670. Top positive contributors to the ASPI were CINS, SFCL, JKH, CTHR and COOP.

While blue-chip counters dominated turnover, lower-valued counters gained momentum. HNW participation remained average, while retail investor activity was high.

Daily turnover stood at LKR 6.9Bn, marking an increase of 9.9% over the monthly average of LKR 6.3Bn. Capital Goods sector led the daily turnover with a share of 28%, followed by the Real Estate Management & Development, and Diversified Financials sectors collectively contributing 29%. Foreign investors remained net sellers, posting a net outflow of LKR 480.2Bn.

BOND MARKET

CBSL keeps OPR unchanged whilst secondary market mood remains cautious

The secondary bond market recorded moderate trading volumes following the CBSL’s decision to maintain the OPR at 7.75%. Buying activity emerged at the short end, whilst sentiment towards the long end remained cautious.

Among the trades that took place today, at the short end, the 15.09.2027 maturity traded between 8.70% to 8.75%, followed by the 15.12.2027 maturity which traded between 8.90% to 8.95%.

Moving on to 2028 maturities, the 15.02.2028 and 15.03.2028 bonds traded within a narrow band ranging from 8.99% to 9.00%. The 01.05.2028 bond traded within 9.06% to 9.09%, whilst 15.10.2028 and 15.12.2028 maturities traded at a rate of 9.20%.

In the 2029 segment, the 15.06.2029 maturity traded between 9.55% to 9.60%, followed by the 15.09.2029 and 15.10.2029 bonds, which transacted between 9.62% to 9.65%. PDMO conducted its weekly T-Bill auction today, raising LKR 125.0Bn in line with the initial offer. The issuance comprised LKR 35.0Bn of 3-month bills, LKR 70.0Bn of 6-month bills, and LKR 20.0Bn of 12-month bills.

Weighted average yields declined across all maturities, settling at 7.84%, 8.26%, and 8.36% for the 3-month, 6-month, and 12-month tenors, easing by 9bps, 10bps, and 11bps, respectively. On the external front, the LKR depreciated against the USD, closing at LKR 309.61/USD compared to LKR 309.56/USD seen previously. Overnight liquidity in the banking system expanded to LKR 211.53Bn from LKR 163.50Bn recorded previously.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..