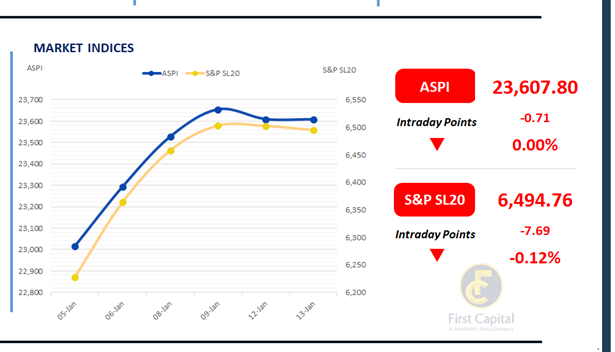

The Colombo Bourse continued yesterday’s selling pressure in the first half of the session and regained the momentum in the latter half slightly below the morning peak.

The ASPI closed at 23,608, down by nearly 1 point while S&P SL20 index moved down by 8 points to close the day at 6,495. Top negative contributors for the ASPI were JKH, DOCK, DFCC, SFCL and HHL.

Daily turnover was recorded at LKR 4.9Bn, representing an increase of approximately 10.4% above the monthly average level of LKR 4.5Bn. HNW participation remained low, while retail activity was comparatively stronger.

The real estate sector and selected foreign currency earning counters attracted notably higher investor interest. The Capital Goods counters contributed 19% of total turnover, while Banking and Diversified Financials sectors together accounted for 29%. Foreign investors turned net buyers, posting a net inflow of LKR 22.1Bn.

BOND MARKET

Muted trading activity amid T-Bill auction proceedings

The secondary bond market drifted through a quiet session amidst the scheduled T-Bill auction, at which the amount raised fell marginally short of the initial offer. Investor participation remained limited, in the secondary market resulting in low trading volumes, while some selling pressure was observed at the shorter end of the yield curve.

Today’s transactions included several 2028 maturities including, 15.02.2028, 01.07.2028, 15.10.2028, and 15.12.2028, all of which traded within a yield range of 9.20% to 9.40%. Additionally, the 15.06.2029 and 15.12.2029 maturities traded between 9.60% and 9.85%. The 15.10.2030 maturity traded at 9.95%, followed by the 15.03.2031 maturity at 10.20%.

Lastly, the 15.06.2035 maturity changed hands within a range of 11.15% to 11.20%. The PDMO raised a total of LKR 96.4Bn against the offered amount of LKR 100.0Bn at today’s T-Bill auction, despite total bids amounting to LKR 347.3Bn. Of this, LKR 32.0Bn was raised via the 3-month bill, in line with the amount offered, with the yield increasing by 7bps to 7.95%.

The 6-month bill raised LKR 62.3Bn against an offer of LKR 48.0Bn, while the yield remained unchanged at 8.44%. Lastly, LKR 2.1Bn was raised against an offer of LKR 20.0Bn in the 12-month segment, with the yield edging up by 1bp to 8.48%.

On the external front, the LKR appreciated against the USD, closing at LKR 309.05/USD compared to LKR 309.38/USD recorded the previous day. Overnight liquidity in the banking system contracted to LKR 151.97Bn from LKR 168.89Bn recorded previously.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..