The Colombo Stock Exchange experienced improved investor sentiment following the holiday season. During the trading session, the ASPI opened with a slight uptick and then moved steadily upward throughout the trading session, showing consistent buying interest across the day.

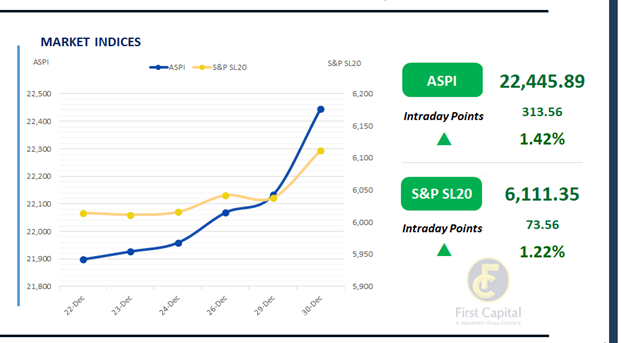

ASPI increased by 314 points to close at 22,446 while S&P SL 20 moved up by 74 points closing at 6,111. Top positive contributors to the ASPI were DOCK, MELS, HNB, RICH and COMB. Daily turnover recorded at LKR 3.4Bn, which is about 3% below the monthly average level of LKR 3.5Bn.

Both retail and HNW investor sentiment remained strong, with retail investors showing particular interest in Banking sector counters during the trading session. Consumer Services sector counters, particularly hotel stocks, attracted notable buying interest following the strong post-crisis tourism arrival numbers recorded.

The Capital Goods sector accounted for 34% of total turnover, while the Banking, and Materials sectors contributed a combined 34%. Foreign investors remained net sellers, posting a net outflow of LKR 36.7Mn.

BOND MARKET

Final T-Bond auction for 2025 concludes amid thin trading volumes

The secondary bond market recorded moderate activity during the session, although volumes remained thin amid a largely unchanged yield curve, with a mild upward push observed at the belly.

In this context, the CBSL conducted its final T-Bond auction for the year, where total acceptances fell short of the initial offer, despite increased bids. Trading activity was primarily concentrated at the short end of the yield curve, with notable transactions across 2028 maturities.

The 01.05.2028 maturity traded at a yield of 9.10%, followed by the 01.07.2028 bond at 9.14%. The 15.10.2028 maturity traded at a yield of 9.20%, while the 15.12.2028 maturity traded at 9.24%. Lastly, the 01.07.2029 maturity also changed hands at 9.87%.

At today’s T-Bond auction, the CBSL adopted a cautious stance, accepting LKR 43.2Bn against the initial offer of LKR 55.0Bn. A sum of LKR 18.2Bn was raised from the 01.07.2030 maturity at a weighted average yield of 9.80%, while LKR 25.0Bn was accepted for the 01.07.2037 bond, in line with the offer, at a weighted average yield of 10.90%.

On the external front, the LKR depreciated against the USD, closing at LKR 309.83/USD compared to LKR 309.71/USD recorded the previous day. Overnight liquidity in the banking system expanded to LKR 124.3Bn from LKR 118.6Bn recorded previously.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..