The Colombo Bourse traded in a largely subdued manner throughout the session, with the index experiencing brief upticks amidst volatility but mostly moving within a narrow band closing the session in the positive territory.

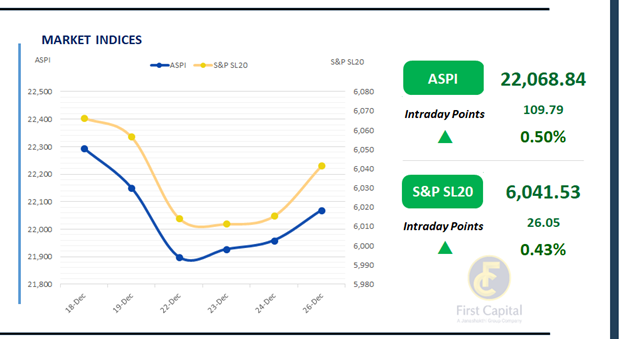

ASPI, increased by 110 points to close at 22,069 while S&PSL 20 ended in positive territory after moving 26 points to close at 6,042. Top positive contributors to the ASPI were HNB, DOCK, NDB, RICH and LION.

Daily turnover was LKR 2.7Bn, which is about 25% below the monthly average of LKR 3.6Bn. The Banking sector accounted for 38% of total turnover, while the Capital Goods and Food Beverage & Tobacco sectors contributed a combined 20%. Foreign investors turned net buyers, posting a net inflow of LKR 18.9Mn.

BOND MARKET

Pre-auction buying drives a decline in yields across the belly end of the curve

Ahead of the final T-bond auction of 2025, the secondary market shifted from previous day’s selling sentiment to buying sentiment, resulting in a 10–12bps decline in yields across the belly end of the curve.

On the back of buying interest, the 15.02.2028 and 15.03.2028 maturities traded at the rate of 9.00%, while the 01.05.2028 maturity changed hands at the rate of 9.05%. 15.10.2028 and 15.12.2028 maturities traded in the range of 9.15% to 9.25%.

Further along the curve, the 15.09.2029 maturity change hands at the rate of 9.65%, and both 15.10.2029 and 15.12.2029 maturities traded at the rate of 9.70%. Moving further, 01.07.2030 maturity traded at the rate of 9.75%, while the 15.03.2031 maturity changed hands at the rate of 9.95%.

Additionally, the 01.10.2032 maturity traded between the range of 10.30% to 10.34%. On the external front, the LKR depreciated against the USD, closing at LKR 309.71/USD compared to LKR 309.66/USD seen previously. Overnight liquidity in the banking system expanded to LKR 111.7Mn from LKR 102.5Mn recorded previously.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..