The Colombo Bourse ended the day in positive territory, reversing the selling sentiment observed during previous sessions.

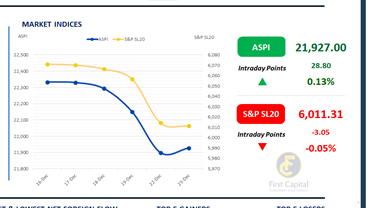

Colombo Dockyard share exerted a large contribution to the uptick in the ASPI, which moved up by 29 points to close at 21,927. However, the S&P SL20 eased by 3 points to close at 6,011.

Top positive contributors to the ASPI were DOCK, RICH, SAMP, JKH and CARG. Both HNW and retail investors moderately engaged in the trading today, posting a daily turnover of LKR 2.6Bn, which is about 30% below the monthly average of LKR 3.6Bn.

The Capital Goods sector accounted for 40% of total turnover, weighing on the contribution from Colombo Dockyard share, while the Banking and Diversified Financials sectors contributed a combined 21%. Foreign investors turned net sellers, posting a net outflow of LKR 68.6Mn

BOND MARKET

Selling pressure pushes short to mid yields higher

The secondary market witnessed an emergence of selling pressure today while the yield curve saw an uptrend, confined to the short to mid segment.

At today’s T-Bill auction, the CBSL accepted only a portion of the amounts on offer, while weighted average yields moved higher across all maturities, most notably with a pronounced 16bps increase in the 1-year bill.

At the short end of the curve a collection of 2028 maturities dated 01.05.2028, 01.07.2028, 15.10.2028 and 15.12.2028 traded at yields of 9.07%, 9.08%, 9.17% and 9.20%, respectively.

Moving on to 2029 maturities, the 15.06.2029, 15.09.2029, 15.10.2029 and 15.12.2029 bonds traded at yields of 9.50%, 9.58%, 9.63% and 9.65%, respectively. At the belly end, the 01.07.2030 bond traded at 9.72%, followed by the 15.06.2035 bond at the long end, which changed hands at 10.68%.

The CBSL’s T-Bill auction which took place today raised at total of LKR 82.5Bn against an offer of LKR 150.0Bn, despite bids reaching LKR 196.1Bn. Accepted volumes stood at LKR 20.2Bn for the 3M T-Bill, LKR 40.1Bn for the 6M T-Bill, and LKR 22.2Bn for the 12M T-Bill, with weighted average yields edging up to 7.55%, 7.95%, and 8.19%, respectively.

On the external front, the LKR slightly depreciated against the USD, closing at LKR 309.55/USD compared to LKR 309.52/USD seen previously. Overnight liquidity in the banking system expanded to LKR 92.2Mn from LKR 88.4Mn recorded by the end of previous week.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..