Ahead of the festive season, the Colombo Bourse opened in negative territory. Selling pressure dominated both the morning and afternoon sessions, particularly as a result of the extended selling pressure observed on the Colombo Dockyard share.

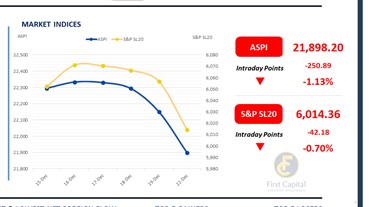

The ASPI declined by 251 points to settle at 21,898, while the S&P SL20 eased by 42 points to close at 6,014. Top negative contributors to the ASPI were DOCK, HNB, RICH, CARG and JKH.

Participation from both HNW and institutional investors remained muted today, reflecting reduced activity ahead of the upcoming festive days. Daily Turnover was at LKR 2.9Bn, which is about 18% below the monthly average of LKR 3.7Bn.

The Capital Goods sector accounted for 33% of total turnover, while the Materials and Banking sectors contributed a combined 22%. Foreign investors turned net buyers, posting a net inflow of LKR 8.6Mn.

BOND MARKET

A muted mood heading into the festive season

The secondary market reflected a dull trading session, with limited activity and thin volumes observed during the day. Among the trades executed, the 15.06.2029 traded at 9.45%, while the 15.12.2029 maturity changed hands at 9.55%.

On the external front, the LKR slightly appreciated against the USD, closing at LKR 309.52/USD compared to LKR 309.72/USD seen previously. Overnight liquidity in the banking system expanded to LKR 88.4Mn from LKR 65.9Mn recorded by the end of previous week.

Moreover, the Department of Census and Statistics published the NCPI for Nov-2025, which has decreased to 2.4% compared to 2.7% in Oct-2025. The YoY inflation of the non-food group remained unchanged at 1.5%.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..