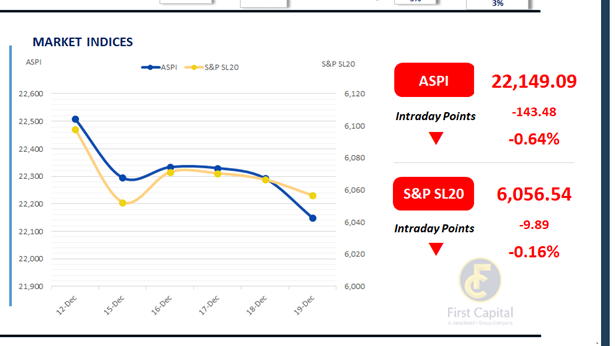

The Colombo Bourse opened the day high and declined sharply during early trading hours followed by a gradual downward drift indicating sustained selling interest with limited buying support.

ASPI declined by 143 points to close at 22,149 and the S&P SL20 moved down by 10 points to end at 6,057. Top negative contributors to the ASPI were DOCK, MELS, HHL, JKH and NDB.

Participation from both HNW and retail investors remained subdued today, continuing the muted engagement that was observed throughout the week.

Daily Turnover was at LKR 3.5Bn, which is about 7% below the monthly average of LKR 3.7Bn. The Capital Goods sector accounted for 31% of total turnover, while the Materials and Food Beverage & Tobacco sectors contributed a combined 22%. Foreign investors turned net sellers, posting a net outflow of LKR 42.6Mn.

BOND MARKET

Low volumes persist as belly segment faces selling pressure

The secondary market yield curve saw mild selling pressure in the belly segment, leading to a slight uptick in yields amid low trading volumes. Among the trades executed, the 15.02.2028 and 01.05.2028 maturities traded at 9.02%, while the 01.07.2028 maturity changed hands at 9.10%.

The 15.09.2029 and 15.10.2029 maturities traded at 9.50% and 9.55%, respectively, while both the 15.05.2030 and 01.07.2030 maturities traded at 9.65%.

Further along the curve, the 15.03.2031, 01.10.2032, and 15.12.2032 maturities traded at 9.90%, 10.30%, and 10.35%, respectively, while the 01.11.2033 and 15.06.2035 maturities traded at 10.45% and 10.65%, respectively.

On the external front, the LKR slightly depreciated against the USD, closing at LKR 309.72/USD compared to LKR 309.65/USD seen previously. Overnight liquidity in the banking system contracted to LKR 65.9Mn from LKR 66.1Mn recorded on the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..