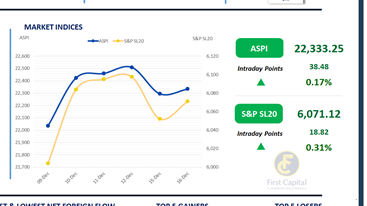

The Colombo Bourse experienced an initial dip, followed by a session of mild volatility amidst consolidation, before ultimately closing above the previous day’s level, gaining 38 points to close at 22,333, while the S&P SL20 moved up 19 points to end at 6,071.

Top positive contributors to the ASPI were DOCK, COMB, SAMP, MELS and DFCC. Despite the overall upward movement in the market, 120 counters closed in negative territory. However, gains in key Banking sector counters drove the market higher.

Both HNW and retail participation remained modest, contributing to a lower daily turnover of approximately LKR 2.9Bn, which is about 28% below the monthly average of LKR 3.9Bn.

The Diversified Financials sector accounted for 23% of total turnover, while the Capital Goods and Food Beverage & Tobacco sectors contributed a combined 35%. Foreign investors turned net sellers, posting a net outflow of LKR 42.8Mn.

Yield curve steady amid mixed trading sentiment

The secondary market yield curve remained unchanged, reflecting mixed sentiment and mixed trading activity. In the 2028 maturity segment, the 15.02.2028, 01.05.2028, 01.07.2028, and 15.12.2028 securities traded at yields of 8.99%, 9.05%, 9.08%, and 9.15%, respectively.

Moving to 2029 maturities, the 15.06.2029, 15.09.2029, and 15.10.2029 maturities changed hands at yields of 9.40%, 9.45%, and 9.50%, respectively. Further along the curve, the 15.05.2030 maturity traded at 9.60%, while the 01.12.2031 maturity was transacted at 10.05%.

Additionally, the 01.10.2032, 01.11.2033, and 15.06.2035 maturities traded at yields of 10.25%, 10.40%, and 10.65%, respectively. On the external front, the LKR depreciated against the USD, closing at LKR 309.26/USD compared to LKR 309.15/USD seen previously. Overnight liquidity in the banking system expanded to LKR 74.2Mn from LKR 69.8Mn recorded on the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..