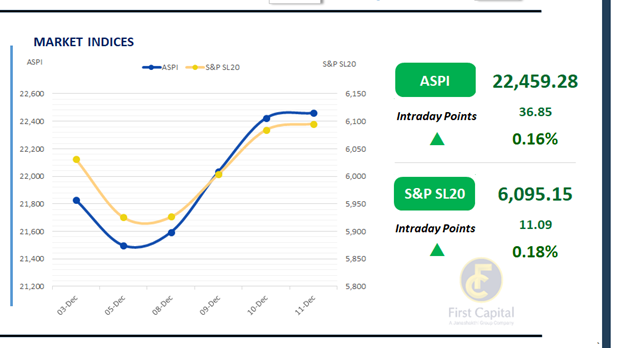

Colombo Bourse, ASPI climbed sharply at the open and traded steadily through the late morning before experiencing a session of profit taking before closing the day with a partial recovery.

The ASPI advanced 37 points to close at 22,459, while the S&P SL20 climbed 11 points to end at 6,095. Top contributors to the ASPI were DOCK, CINS, CFIN, HHL, and SUN.

HNW participation remained low, yet retail investors showed significant interest, resulting in a daily turnover of around LKR 5.6Bn, which is 20% above the monthly average turnover of LKR 4.6Bn.

The Capital Goods sector accounted for 31% of total turnover, while the Food Beverage & Tobacco and Energy sectors contributed a combined 30%. Foreign investors remained net sellers, posting a net outflow of LKR 150.5Mn.

Market maintains moderate activity whilst T-Bond acceptances fall short

The secondary market remained subdued today as investor engagement remained limited with some selling sentiment, amidst moderate trading volumes. Trading activity was primarily confined to the short to mid end of the curve, with 2028, 2029 and 2031 bonds seeing some activity.

Among the 2028 maturities, 15.02.2028 traded between 9.10% to 9.15%, followed by 01.05.2028, 01.07.2028, 15.10.2028, all of which traded between 9.15% to 9.20%. Moving along, the 15.06.2029 bond changed hands at 9.45% whilst 15.09.2029 and 15.10.2029 maturities traded within a yield band of 9.45% to 9.55%. Lastly, the 15.03.2031 maturity traded at a yield of 9.95%.

The CBSL conducted a T-Bond auction today, raising LKR 115.5Bn across three maturities against an initial offer of LKR 143.0Bn, despite total bids amounting to LKR 272.7Bn. The 01.03.2030 bond recorded acceptances of LKR 15.5Bn at a yield of 9.55%, while the 01.10.2032 bond saw LKR 30.0Bn accepted which is in line with the initial offer, at a yield of 10.29%.

The 15.06.2035 bond was also accepted in full against the initial offer of LKR 70.0Bn, with the yield settling at 10.67%. On the external front, the LKR slightly depreciated against the USD, closing at LKR 308.75/USD compared to LKR 308.65/USD seen previously. Overnight liquidity in the banking system expanded to LKR 109.5Mn from LKR 97.8Mn recorded on the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..