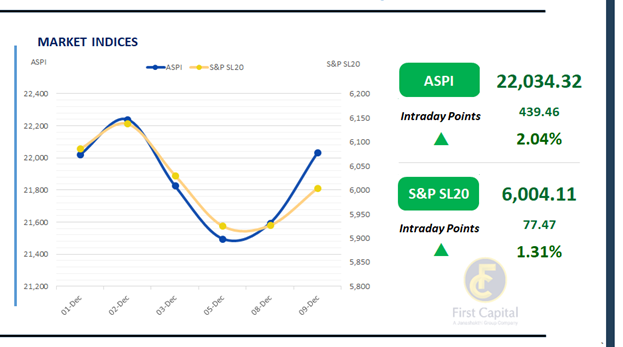

The Colombo Bourse took a sharp incline at the beginning of the session and continued to move upward amid minor fluctuations.

The ASPI advanced 439 points to close at 22,034, while the S&P SL20 edged up 77 points to end at 6,004. Top contributors to the ASPI were DOCK, CINS, COMB, SAMP and ACL.

HNW participation were low while retail investors showed a moderate interest, resulting in a daily turnover of around LKR 3.9Bn, which is 17% below the monthly average that stands at around 4.7Bn.

The Capital Goods sector accounted for 29% of total turnover, while the Materials and Banking sectors contributed a combined 32%. Foreign investors

turned net sellers, posting a net outflow of LKR 149.1Mn.

BOND MARKET

Buying interest emerges, pushing the yield curve slightly lower

The secondary market yield curve saw renewed buying interest, supported by foreign participation, which generated moderate trading volumes.

Among the limited transactions recorded, the 15.02.2028, 01.05.2028, and 01.07.2028 maturities traded between 9.25% and 9.20%. The 15.06.2029 and 01.07.2030 maturities changed hands at 9.50% and 9.70%, respectively, while the 15.12.2032 maturity traded within the range of 10.25% to 10.30%.

Further along the curve, the 01.06.2033 and 01.11.2033 maturities traded within a range of 10.49% to 10.60%. On the external front, the LKR slightly appreciated against the USD, closing at LKR 308.61/USD compared to LKR 308.66/USD seen previously. Overnight liquidity in the banking system expanded to LKR 101.4Mn from LKR 85.7Mn recorded on the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..