The Colombo Bourse recorded a sharp drop from the early start of the day’s session, driven by uncertainty surrounding weather forecasts that warn of persistent heavy rainfall in the days ahead.

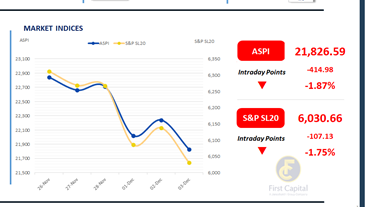

After a continuous downward movement of the index, ASPI settled at 21,827 level, moving 415 points down while S&P SL 20 dipped by 107 points, closing at 6,031. Investor activity was muted with both retail and HNW showing notably lower participation

.

CINS, MELS, COMB, SFCL, and BUKI emerged as the top negative contributors to today’s bear-market performance. Market turnover declined to LKR 3.8Bn, down 5.7% from the previous day, and 23.6% below the monthly average.

The Capital Goods sector generated 38.6% of the day’s turnover, while the Banking and Materials sectors together accounted for 26.7%. Foreign investors remained net sellers, posting a net outflow of LKR 295.5Mn.

BOND MARKET

Cautious market mood results in softened trading activity

The secondary bond market recorded yet another session of moderate volumes and limited activity, as the broader macroeconomic outlook remains uncertain in the aftermath of the cyclone and floods. In line with recent sessions, selling interest persisted, including a measure of foreign selling.

Among the trades executed today, the 15.09.2027 maturity traded at a yield of 9.00%. This was followed by a group of 2028 maturities, including 15.02.2028, 15.03.2028, 01.05.2028 and 01.07.2028, all of which were seen trading within the 9.20% to 9.40% range. The 15.06.2029 and 15.10.2029 bonds also registered activity, changing hands at 9.55% to 9.65%.

Moving towards the belly end, the 15.05.2031 traded at 10.20% to 10.30%, while the 01.11.2033 maturity traded at 10.60%. On the external front, the LKR depreciated against the USD, closing at LKR 308.83/USD compared to LKR 308.51/USD seen previously. Overnight liquidity in the banking system expanded to LKR 102.8Mn from LKR 97.0Mn recorded on the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..