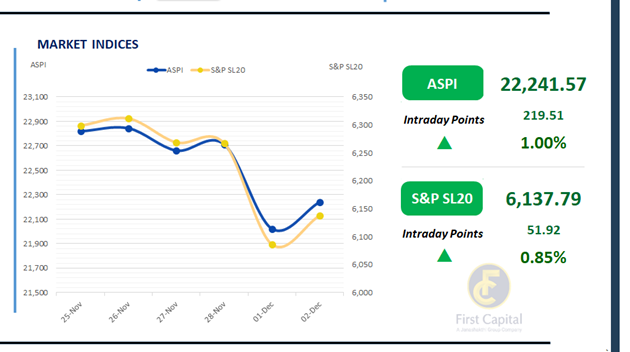

The Colombo Bourse opened on a positive note today, rebounding from yesterday’s downturn as investors capitalized on emerging bargain-hunting opportunities.

The ASPI picked up at a strong early momentum and closed the day at 22,242, marking a 220 points improvement over the previous session.

Top contributors for the ASPI were RICH, CINS, SAMP, BUKI and NDB. Participation from HNW investors remained restrained while retail investors sought bargain hunting opportunities.

Daily turnover reached LKR 4.0Bn, 20.3% below the monthly average of LKR 5.0Bn. The Capital Goods sector generated 29.0% of the day’s turnover, while the Banking and Materials sectors together accounted for 36.3%. Foreign investors remained net sellers, posting a net outflow of LKR 197.6Mn.

BOND MARKET

Trading appears limited as uncertainties linger

Owing to the persistence of uncertainties triggered by adverse weather conditions, the secondary market witnessed yet another day of limited activity.

However, similar to yesterday, some selling pressure was evident. Moreover, CBSL conducted its weekly T-Bill auction today, raising a mere fraction of the original offer while weighted average yields held largely steady.

Today the Central Bank appeared cautious in its acceptance of bids raising LKR 15.8Bn against the initial offer of LKR 48.0Bn. The 3M T-bill raised LKR 3.9Bn while the weighted average yield inched 1-bps down to 7.51%.

The 6M and 12M bills raised LKR 9.3Bn and LKR 2.6Bn respectively, while weighted average yields held steady at 7.91% and 8.03%. At the short end of the curve, 15.10.2029 and 15.12.2029 traded between 9.60% to 9.70% while 01.07.2030 traded at 9.70%.

Moving ahead, 15.03.2031 was seen changing hands between 9.99% to 10.07% and 15.12.2032 traded at a rate of 10.35%. In terms of 2033 maturities 01.06.2033 and 01.11.2033 were seen trading between 10.50% to 10.55%.

Finally, 15.09.2034 traded at 10.65% while 15.06.2035 traded higher at 10.72%. On the external front, the LKR depreciated against the USD, closing at LKR 308.51/USD compared to LKR 308.07/USD seen previously. Overnight liquidity in the banking system expanded to LKR 97.0Mn from LKR 86.3Mn recorded on the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..