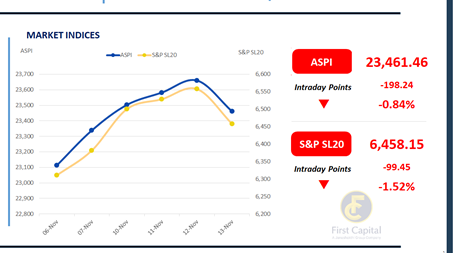

The Colombo Bourse closed in negative territory as investors engaged in profit-taking, with the ASPI declining by 198 points to end at 23,461.

Retail participation remained moderate, while HNW activity was relatively subdued. The downturn was primarily driven by banking and selected blue-chip counters, with SAMP, HNB, JKH, NDB, and BUKI emerging as the key negative contributors to the index.

Market turnover amounted to LKR 6.4Bn, reflecting a 6% decline compared to the monthly average of LKR 6.8Bn. The Banking sector dominated market activity, accounting for 39% of total turnover, followed by the Materials and Capital Goods sectors, which jointly contributed 29%.

Meanwhile, foreign investors remained net sellers, recording a net outflow of LKR 788.7Mn for the session.

BOND MARKET

Mixed sentiment resumes amidst the T-Bond auction

The secondary bond market demonstrated mixed sentiment amidst moderate activity levels, leaving the yield curve largely stationary. The CBSL conducted the first T-Bond auction for the month, at which LKR 80.0Bn was raised, in line with the initial offer.

A reasonable level of trades were executed across the yield curve today. Amongst the 2028 maturities, the 15.03.2028 bond traded at 8.90% followed by the 01.05.2028 bond at 8.95%. Maturities dated 01.07.2028, 01.09.2028 and 15.10.2028 traded at 9.00%.

Moving towards the mid end of the curve, the 15.09.2029, 15.10.2029 and 15.12.2029 bonds traded at yields of 9.45%, 9.40% and 9.45% respectively. The 01.07.2030 maturity traded at 9.56%, followed by the 15.03.2031 maturity at 9.80% and the 01.07.2032 maturity at 10.30%.

Furthermore, bonds maturing on 01.10.2032 and 15.12.2032 traded at a yield of 10.20%. Within the 2033 segment, bonds maturing on 01.06.2033 and 01.11.2033 traded at 10.40%.

Lastly, towards the long end of the curve, the 15.06.2035 maturity was seen changing hands at 10.70%. The CBSL conducted a T-Bond auction today, at which the full amount on offer was raised across two maturities.

As per the initial plan, LKR 35.0Bn was raised through the 2030 maturity and LKR 45.0Bn was raised through the 2035 maturity. The weighted average yields of the maturities stood at 9.56% and 10.69%, respectively.

On the external front, the LKR depreciated against the USD, closing at LKR 304.52/USD compared to LKR 304.28/USD seen previously.

Overnight liquidity in the banking system expanded to LKR 162.43Bn from LKR 146.61Bn recorded on the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..