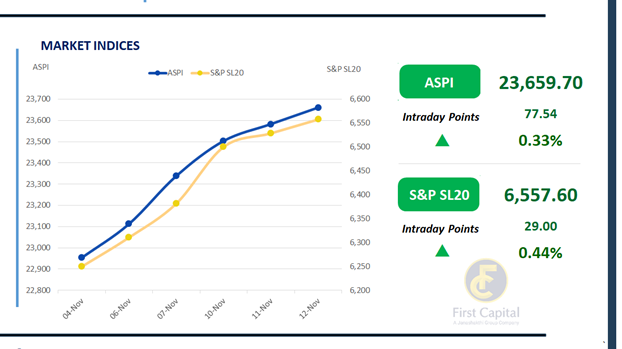

The Colombo Bourse extended its positive momentum, with the ASPI gaining 78 points to close at 23,660. Renewed investor interest was seen across low and mid-tier banking counters, while retail participation remained moderate amid continued strong HNW interest.

RICH, JKH, SFCL, VONE, and SPEN were among the key positive contributors to the index. Market turnover reached LKR 7.2Bn, reflecting a 6% uptick compared to the monthly average of LKR 6.8Bn.

The Capital Goods sector led market activity, accounting for 26% of total turnover, followed by the Banking and Retailing sectors, which jointly contributed 31%. Meanwhile, foreign investors turned net sellers, posting a net outflow of LKR 57.7Mn for the session.

BOND MARKET

Secondary market extends profit taking ahead of the T-bond auction

The secondary bond market witnessed profit taking ahead of the T-Bond auction scheduled for 13-Nov-2025. The yield curve slightly edged up, amidst the low volumes experienced in the market.

Among the traded maturities, 15.02.2028 and 15.03.2028 traded between 8.90%-8.95%, while 01.05.2028 and 01.07.2028 traded between 8.95%-9.00%. 15.06.2029 and 15.09.2029 maturities traded at 9.35% and 9.45%, respectively.

Also, 01.07.20230 maturity traded at 9.56%. Moreover, 15.03.2031 maturity changed hands at 9.80%-9.85%, while 01.07.2032 maturity traded between 10.30%-10.35%. Additionally, 01.11.2033 maturity changed hands at 10.45%.

The CBSL conducted its weekly T-Bill auction today, raising LKR 43.3Bn, falling short of the offered amount of LKR 77.0Bn. The 3M bill raised LKR 3.5Bn, falling short of its initial offer of LKR 10.0Bn, while the yield remained unchanged at 7.52%. The 6M bill exceeded its initial offer of LKR 30.0Bn, raising LKR 36.0Bn, with the yield changing by 1bps to 7.91%.

Meanwhile, the 12M bill raised LKR 3.8Bn, falling below its initial offer of LKR 37.0Bn, as the yield remained unchanged at 8.04%. On the external front, the LKR appreciated marginally against the USD, closing at LKR 304.28/USD compared to LKR 304.39/USD seen previously.

Overnight liquidity in the banking system expanded to LKR 146.61Bn from LKR 145.28Bn recorded on the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..