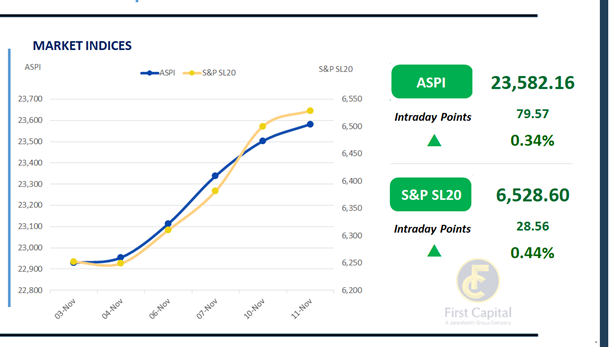

The Colombo Bourse experienced mixed sentiment during early trading but eventually closed in positive territory, with the ASPI advancing 80 points to end at 23,582.

Both retail and HNW participation remained robust throughout the session. RICH, DIAL, DFCC, AEL, and HNB emerged as key positive contributors to the index.

Market turnover stood at LKR 8.2Bn, reflecting a 21% increase against the monthly average of LKR 6.8Bn. The Capital Goods sector dominated activity, accounting for 28% of total turnover, followed by the Banking and Food, Beverage & Tobacco sectors, which collectively contributed 35%.

Meanwhile, foreign investors turned net buyers, recording a net inflow of LKR 26.0Mn for the day.

BOND MARKET

Secondary market yield curve holds steady ahead of bond auction

Ahead of the T-Bond auction scheduled for 13th November 2025, the secondary market showed a slowdown in activity, although some buying interest re-emerged.

The secondary market yield curve remained broadly stable, experiencing limited trading activity. Among the traded maturities, 01.05.2028 and 01.07.2028 changed hands at 8.90% and 8.95%, respectively, while 15.10.2028 and 15.12.2028 were traded at 9.00%. 15.06.2029, 15.09.2029, and 15.10.2029 maturities traded at the rates of 9.34%, 9.39%, and 9.40%, respectively. In the 2030 maturities, 15.05.2030, 01.07.2030, and 15.10.2030 traded at the rates of 9.55%, 9.56%, and 9.60%, respectively.

Meanwhile the 15.09.2034 maturity changed hands at the rate of 10.56%. On the external front, the LKR appreciated marginally against the USD, closing at LKR 304.39/USD compared to LKR 304.95/USD seen previously. Overnight liquidity in the banking system expanded to LKR 145.28Bn from LKR 142.49Bn recorded on the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..