The Colombo Bourse remained largely in consolidation mode during the early session but trended downward in the latter part of the day, closing in negative territory.

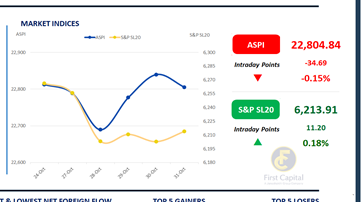

The ASPI declined by 35 points to end at 22,805. Retail participation remained moderate throughout the session, while strong HNW activity was observed, primarily driven by large-scale crossings in SPEN and LGL.

Key negative contributors to the index included BUKI, LION, CARS, RICH, and HARI.

Market turnover amounted to LKR 5.6Bn, reflecting a 26% decline compared to the monthly average of LKR 7.5Bn. The Capital Goods sector led market activity, contributing 29% of total turnover, followed by the Materials and Diversified Financials sectors, which collectively accounted for 23%. Meanwhile, foreign investors remained net sellers, recording a net outflow of LKR 892.8Mn for the day.

BOND MARKET

Subdued secondary market activity keeps yield curve unchanged

The secondary bond market remained subdued today, with low activity and thin trading volumes, leaving the overall yield curve unchanged. In terms of traded securities, within the 2028 maturities, the 01.05.2028 bond traded at 9.10%, the 01.07.2028 at 9.15%, and both the 15.09.2028 and 15.10.2028 at 9.20%.

In the 2029 segment, the 15.06.2029 bond traded at 9.52%, while the 15.09.2029 and 15.10.2029 issues traded at 9.60%. Meanwhile, the 01.07.2030 bond recorded trades at 9.74%, and the 15.09.2034 maturity closed at 10.70%.

On the external front, the LKR depreciated against the USD, closing at LKR 304.4/USD compared to LKR 304.3/USD seen previously. Overnight liquidity in the banking system expanded to LKR 155.1Bn from LKR 153.7Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..