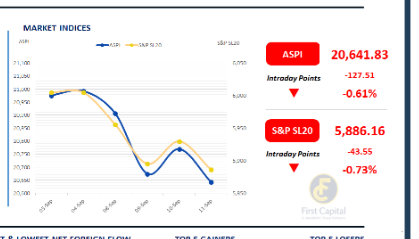

Continuing the buying momentum from yesterday, the Colombo Bourse opened on a positive note, but ultimately ended in negative territory.

The ASPI lost 128 points, closing at 20,642. Banks and blue-chip companies caused the downfall of the index, with HNB, CARG, DFCC, JKH and DIAL emerged as the top negative contributors.

The turnover fell to LKR 6.6Bn, reflecting a 14% decrease over the monthly average of LKR 7.7Bn. Real Estate sector led the turnover with a 31% share, predominantly due to higher offboard transactions on PLR.

Capital Goods sector and Materials sector jointly contributed to 27% of the turnover. Foreign investors turned net buyers, recording a net inflow of LKR 54.4Mn.

Bond auction acceptance falls short

CBSL concluded the scheduled T-Bond auction today, following which the secondary market saw some trading activity; however, volumes remained insufficient to prompt any movement in the yield curve.

Among the traded maturities, the 15.09.2029 bond was executed at a yield of 9.53%, while the 15.12.2029 bond traded at 9.55%. Meanwhile, the 15.05.2030 and 01.07.2030 maturities saw trades around 9.70%.

At today's T-Bond auction, CBSL raised only part of the targeted LKR 155.0Bn. The initial plan aimed to raise LKR 85.0Bn through a 2030 maturity bond carrying an 9.75% coupon, LKR 25.0Bn via a 2032 maturity bond with a 9.00% coupon and LKR 45.0Bn via a 2035 maturity bond with a 10.70% coupon.

However, only LKR 46.2Bn was accepted from the 2030 bond, while the 2032 and 2035 bonds successfully raised their full initial offerings.

In the forex market, the LKR depreciated slightly against the greenback, closing at LKR 302.0/USD, compared to the previously seen rate of LKR 301.9/USD. Meanwhile, overnight liquidity in the banking system expanded to LKR 169.6Bn from the previously seen level of LKR 160.6Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..