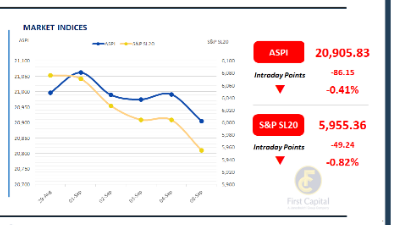

The Colombo Bourse evidenced high levels of volatility, particularly during the second half of the day, with the ASPI ultimately closing at 20,906, marking a downtick of 86 points.

The ASPI showcased positive momentum in the early hours and gradually started to fall during midday, after which it posted a volatile session.

HNB, COMB, DFCC, CINS and JKH were the top negative contributors to the index. Both retail and HNW participation remained positive during the session.

Turnover for the day amounted to LKR 6.2Bn, which is 10% lower than the monthly average of LKR 6.8Bn. The Capital Goods sector led turnover contributions with an 18% share, while the Real Estate and Banking sectors collectively contributed 20%.

Foreign investors turned net sellers, recording a net outflow of LKR 50.7Mn.

BOND MARKET

Secondary market opens the week on a subdued note

The secondary bond market began the week on a quiet note, characterized by subdued trading volumes and minimal investor participation.

As a result, the yield curve remained largely unchanged, reflecting the lack of significant market movement. Amid the few trades that occurred today, the 15.02.2028 maturity was traded at a yield of 8.85%, while the 01.07.2028 maturity saw trades occur within a tight yield range of 9.00% to 9.01%.

In the forex market, the LKR appreciated against the greenback, closing at LKR 302.0/USD compared to LKR 302.1/USD seen previously. Meanwhile, overnight liquidity in the banking system expanded to LKR 155.9Bn from the previously seen level of LKR 144.4Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..