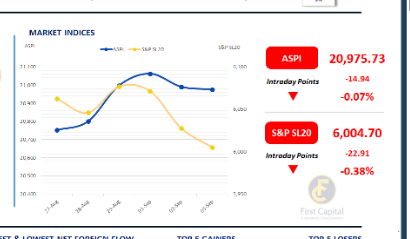

The Colombo Stock Exchange witnessed a volatile day of trading with investors demonstrating a profit booking appetite. The ASPI edged lower as it dropped 15 points to close at 20,976.

The index showed positive movement during the early trading hours but soon came under selling pressure, pulling it lower. It later recovered, but closed below yesterday's level, succumbing to the intraday volatility observed today.

Banks emerged as the top draggers, with HNB, NDB and COMB leading the declines, alongside RICH and JKH. Retail and HNW investors showed moderate levels of engagement which resulted in a market turnover of LKR 6.5Bn, which is broadly on par with the monthly average that stands at LKR 6.9Bn.

The Consumer Durables & Apparel sector led turnover contributions with a 20% share, while the Consumer Services, and Capital Goods sectors stood next in line, with a collective contribution of 31%. Foreign investors remained net buyers, recording a net inflow of LKR 53.3Mn.

BOND MARKET

Yields hold steady at the weekly T-Bill auction

The secondary bond market saw subdued performance, characterized by limited activity and thin trading volumes. Amongst the traded maturities, 15.12.2026, 01.05.2027 and 15.12.2029 bond maturities were traded at the rates of 8.25%, 8.60% and 9.53%, respectively.

Today, CBSL accepted LKR 49.7Bn at its weekly T-Bill auction, below the targeted LKR 74.0Bn, despite total bids reaching LKR 119.2Bn. For the 3M tenor, LKR 4.5Bn was accepted from LKR 16.1Bn in bids, with the yield remaining unchanged at 7.58%.

The 6M bill saw LKR 38.1Bn accepted, from LKR 66.6Bn in bids, as the weighted average yield held steady at 7.89%. In the 12M maturity, LKR 7.0Bn was accepted from LKR 36.5Bn in bids, with the yield unchanged at 8.03%.

In the forex market, the LKR depreciated marginally against the greenback, closing at LKR 302.1/USD compared to LKR 302.0/USD seen previously. Meanwhile, overnight liquidity in the banking system expanded to LKR 138.8Bn from the previously seen level of LKR 127.4Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..