The Colombo Stock Exchange closed the week with strong upward momentum as market optimism sustained for a fourth consecutive session.

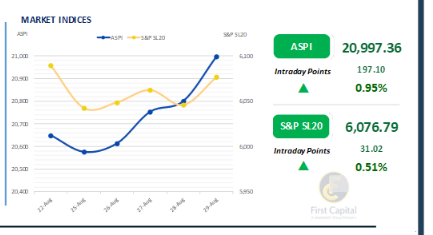

The ASPI showed early strength, briefly surpassing the 21,000 level during late morning trading. Although the index experienced a period of volatility and a mild slowdown around midday, it regained traction toward the close and ended the session with a 197-point gain at 20,997, narrowly missing the 21,000 mark.

Top positive contributors to the index were CINS, DIAL, SFCL, RICH and JKH. Turnover reached LKR 7.4Bn, exceeding the monthly average of LKR 6.5Bn, attributed to heightened activity, primarily from retail investors.

The Consumer Services sector led turnover contributions with a 13% share, followed by the Diversified Financials and Banking sectors, which together accounted for 24%. Foreign investors turned net buyers, recording a net inflow of LKR 184.1Mn.

Selling activity continues as the yield curve edges up slightly

Building on yesterday's selling sentiment, the secondary market yield curve saw slight selling pressure, leading to moderate volumes and activity.

Consequently, the yield curve edged upward slightly from short to belly end. Among the traded maturities, the 01.05.2027 maturity traded between the rates of 8.50% to 8.55%, while the 15.09.2027 bond traded between the rates of 8.60% and 8.65%.

Further along the curve, the 01.05.2028 maturity changed hands at a rate of 8.90%. Additionally, the 15.10.2028 and 15.12.2028 bonds traded between 9.00% and 9.05%.

Meanwhile, the 15.09.2029 and 15.10.2029 maturities changed hands at rates between 9.45% and 9.50%. Furthermore, the 01.07.2030 and 15.03.2031 bonds traded at rates of 9.55% and 9.92%, respectively. In the forex market, the LKR depreciated marginally against the greenback, closing at LKR 302.45/USD compared to LKR 302.33/USD seen previously.

Meanwhile, overnight liquidity in the banking system expanded to LKR 146.5Bn from the previously seen level of LKR 143.2Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..