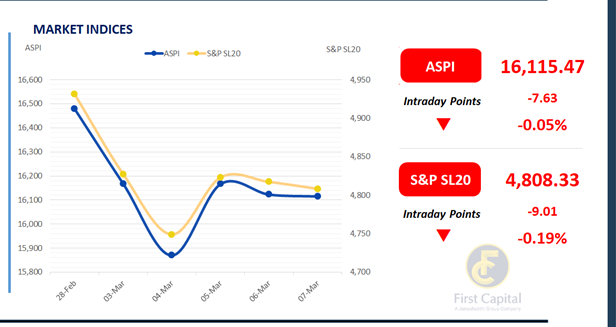

The Colombo Bourse saw little change from yesterday, with a slight dip in both the ASPI and turnover. The index exhibited visible volatility, experiencing a steep drop in the early hours, followed by a recovery that the ASPI managed to maintain throughout the day despite continued fluctuations.

Ultimately, the ASPI ended in the red at 16,115, marking a modest dip of approximately 8 points. LLUB, SAMP, LOLC, DFCC, and COMB were the primary negative contributors to the index, while MELS, HHL, and HNB emerged as the top positive movers.

Turnover also saw a slight decline, dropping to LKR 2.2Bn from LKR 2.4Bn recorded yesterday, still trailing behind the monthly average of LKR 3.2Bn. The Capital Goods sector dominated turnover contributions, accounting for 56%, while the Banking sector and Food, Beverage, and Tobacco sectors collectively contributed 24%.

Mixed sentiment leads to thin volumes and low activity

Market participants continued to show mixed sentiment, resulting in low volumes and limited activity. There was a slight selling interest in 2028 maturities. Meanwhile, the buying interest was also observed during the day.

Amongst the traded maturities at the short end 15.09.2027 traded at 9.46% whilst towards the belly end curve, 15.10.2028 and 15.12.2028 traded at the range of 10.35% to 10.41%. Furthermore, 15.09.2029, 15.10.2030, and 15.03.2031 bond maturities traded at the rates of 10.73%, 11.00% and 11.31%, respectively.

On the external front Sri Lankan rupee depreciated against the greenback and stood at LKR 295.6/USD compared to LKR 295.2/USD recorded on yesterday. Similarly, LKR also depreciated against other major currencies such as GBP, EUR, JPY and CNY.

The CBSL holdings of government securities remained unchanged, closing at LKR 2,511.92Bn today. Overnight liquidity in the banking system expanded to LKR 166.8Bn from LKR 161.0Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..