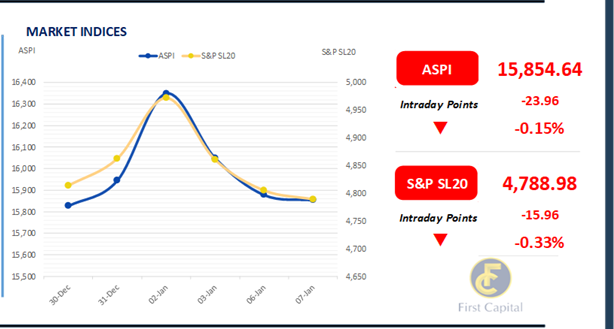

Investors in the Colombo bourse extended the profit taking sentiment for yet another day, as the ASPI experienced a highly volatile trading session.

The ASPI closed the day in the red at 15,855, losing 24 points, despite a partial recovery during midday. A decline in participation from both HNW and retail investors was also observed.

Furthermore, HNB, CFIN, HHL, LION and LOLC emerged as the top negative contributors to the index. Turnover settled lower at LKR 4.6Bn, reflecting a decrease of 39.5% from the monthly average standing at LKR 7.5Bn.

The Banking sector led turnover at 22%, followed by Diversified Financials and Food, Beverage & Tobacco sectors jointly contributing 38% of overall turnover. Meanwhile, the net foreign outflow for the day stood at LKR 48.3Mn.

Mixed sentiment prevails ahead of T-Bill auction

The secondary market yield curve witnessed a day of mixed sentiment amidst the presence of both buying and selling activity.

The yield curve remained relatively stable ahead of tomorrow’s treasury bill auction, where the CBSL is scheduled to raise LKR 102.0Bn in T-Bills, where LKR 30.0Bn is to be raised from the 91-day maturity, LKR 30.0Bn is to be raised from the 182-day maturity, and LKR 42.0Bn is to be raised from the 364-day maturity.

Notable trades were on the short to mid end of the curve, primarily amongst the 2026, 2027, 2028, 2030, and 2032 maturities. On the short end of the curve, 15.05.26, and 01.08.26 both traded between rates of 9.30% - 9.25%.

Similarly, 15.01.27 traded at a rate of 9.58%. On the belly end of the curve, 15.01.28, and 15.02.28 traded between rates of 10.20% - 10.15%. 01.07.28 traded at 10.44% and 15.10.28 traded at a rate of 10.52%.

Additionally, 15.10.30 traded at a rate of 11.15%, while 01.07.32 and 01.10.32 both traded at 11.48%. On the external front, the LKR depreciated against the USD, closing at LKR 294.93/USD compared to LKR 293.56/USD recorded the previous day.

CBSL holdings of government securities remained unchanged, closing at LKR 2,515.62Bn today. Overnight liquidity in the banking system contracted to LKR 136.22Bn from LKR 162.73Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..