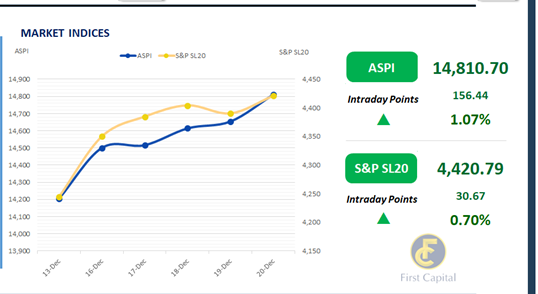

The bourse experienced another day of positive sentiment and increased gains, closing in green for the 19th consecutive day.

After yesterday's volatile trading, the market rebounded strongly with significant gains today. Amidst the increased participation from retail and HNW investors, ASPI closed the day in green at 14,811, gaining 156 points marking a 1.07% increase from the previous day.

The most significant contributors towards the positive index were CFIN, CCS, MELS, AEL, and LLUB. Additionally, specific stocks in Construction sector such as SIRA, AEL and TKYO continued to attract investor interest throughout the day.

Amidst multiple off-board transactions, turnover was at a 10-month high of LKR 9.2Bn, marking an increase of 95.8%, from the monthly average, standing at LKR 4.7Bn.

Moreover, the Capital Goods sector led the turnover by 25%, followed by the Banking and Food Beverage and Tobacco sectors jointly contributing 28% of the overall turnover. There was a net foreign outflow of LKR 226.9Mn.

Dull sentiment arises ahead of the holiday season

The secondary bond market yield curve remained broadly unchanged ahead of the holiday season, with the secondary market witnessing limited activity and ultra-thin volumes.

Amongst the traded maturities, notable trades were recorded particularly in the 15.02.28 and 15.03.28 maturities, with rates being traded between 10.13% and 10.18%.

Meanwhile, on the external front, the LKR continued to depreciate against the USD for the 4th consecutive day, closing at LKR 292.68/USD compared to LKR 291.28/USD recorded the previous day.

Meanwhile, the LKR also depreciated against the other major currencies such as EUR, CNY and AUD and conversely, the LKR appreciated against other major currencies such as the GBP and JPY.

CBSL holdings of government securities remained unchanged, closing at LKR 2,515.62Bn today. Overnight liquidity in the banking system contracted to LKR 171.15Bn from LKR 186.66Bn recorded the previous day.

Furthermore, on the macroeconomic front, the CBSL published the Purchasing Managers’ Index (PMI) results on 16th Dec-24, for the month of November. Accordingly, the PMI for manufacturing and services both recorded values well above the neutral threshold, at 53.3 and 60.5, respectively.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..