The bourse witnessed heightened volatility, driven by mixed sentiment and increased market activity. The S&P SL20 index saw a decline today, primarily driven by price declines in the Banking sector and blue-chip stocks.

LMF experienced increased trading activity today, with a significant volume of shares traded, largely driven by the recent tax reduction and the possible boost to disposable incomes.

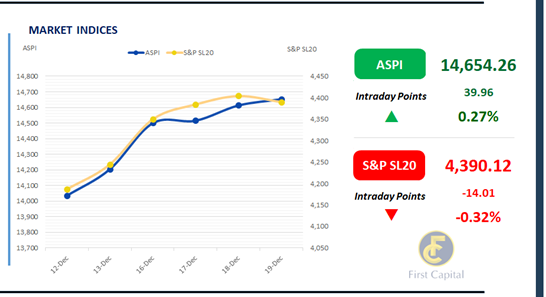

Amidst the increased participation from retail investors, the ASPI closed the day in green at 14,654 gaining 40 points, marking a 0.27% increase from the previous day.

Additionally, CCS, GLAS, JKH, DIPD and LIOC emerged as the top positive contributors to the index. Amidst multiple off-board transactions, turnover stood at LKR 5.9Bn, marking an increase of 24.5%, from the monthly average.

Moreover, the Food Beverage and Tobacco sector led the turnover by 20%, followed by the Capital Goods and Materials sectors jointly contributing 30% of the overall turnover. There was a net foreign outflow of LKR 1.5Mn.

Profit taking emerges post auction

The secondary bond market yield curve witnessed increased profit taking, as the yield curve edged upwards, slightly. Additionally, the CBSL announced the issuance of LKR 120.0Bn in T-Bills, scheduled to be held on 24th Dec-24, where LKR 30.0Bn is to be raised for the 91-day bill, LKR 40.0Bn is to be raised for the 182-day bill, and LKR 50.0bn is to be raised for the 364-day bill.

Notable trades were primarily amongst the 2028, 2029, and 2031 maturities. On the belly end of the curve 15.02.28, 15.03.28, 01.05.28, 01.07.28, and 15.10.28 traded at rates of 10.15%, 10.15%, 10.26%, 10.35%, and 10.40%, respectively.

Similarly, 15.09.29 traded at a rate of 10.75%, and 01.12.31 traded at a rate of 11.38%. Meanwhile, on the external front, the LKR depreciated against the USD, closing at LKR 291.28/USD compared to LKR 290.94/USD recorded the previous day.

Conversely, the LKR appreciated against other major currencies such as the GBP, EUR, AUD, CNY, and JPY. CBSL holdings of government securities remained unchanged, closing at LKR 2,515.62Bn today. Overnight liquidity in the banking system contracted to LKR 186.66Bn from LKR 187.85Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..