The bourse followed the same pattern as the previous day where the market experienced volatility and declined in the morning due to selling and picked up by midday.

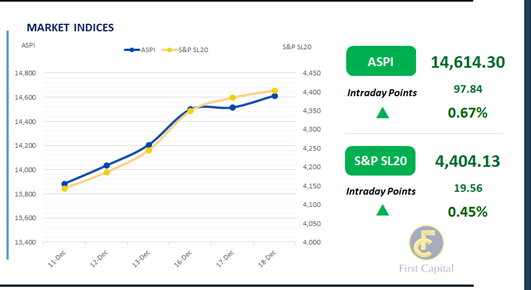

Amidst the increased participation from HNW investors, the ASPI closed the day in green at 14,614 gaining 98 points, marking a 0.67% increase from the previous day.

During today's trading session, most of the investor attention was focused on Banking sector stocks. Additionally, HNB, DIMO, VONE, CFIN and CTC emerged as the top positive contributors to the index.

Amidst multiple off-board transactions, turnover stood at LKR 6.0Bn, marking an increase of 29.5%, from the monthly average.

Moreover, the Banking sector led the turnover by 20%, followed by the Capital Goods and Materials sectors jointly contributing 35% of the overall turnover. There was a net foreign inflow of LKR 100.7Mn.

Auction yields slump down across the board

The Central Bank of Sri Lanka conducted its weekly T-Bill auction today, successfully raising LKR 185.0Bn, with the total offered amount being fully accepted across all maturities.

The 06M bill attracted the most interest, while weighted average yield rates declined across the board for the second consecutive week.

The 03M bill closed at 8.66% (-03bps), the 06M bill at 8.81% (-07bps), and the 1Yr bill at 9.02% (-05bps). In the secondary market, buying appetite persisted, predominantly focused on 2028 bond maturities.

The 15.01.2028 bond closed at 10.05%, while the 15.02.2028 and 15.03.2028 maturities traded at 10.10%. Meanwhile, the 01.05.2028 and 01.07.2028 bonds registered at 10.15% and 10.25%, respectively.

Other notable trades included the 15.09.2029 bond, which closed at 10.65%, while the 01.12.2031 and 01.07.2032 maturities registered at 11.35% and 11.48%, respectively. On the external front, the Sri Lankan rupee continued its depreciation against the USD for the third consecutive session, closing at LKR 290.94/USD. Meanwhile, the rupee exhibited mixed performance against other major currencies, weakening against the GBP and JPY while strengthening against the EUR and AUD.

Meanwhile, overnight liquidity improved at today’s session to LKR 187.85Bn while CBSL Holdings continued to remain stagnant at LKR 2,515.62Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..