The bourse experienced a day of positive sentiment and increased market activity, with interest visible on Diversified Financial sector and Construction sector stocks such as ACL, TKYO, and RCL.

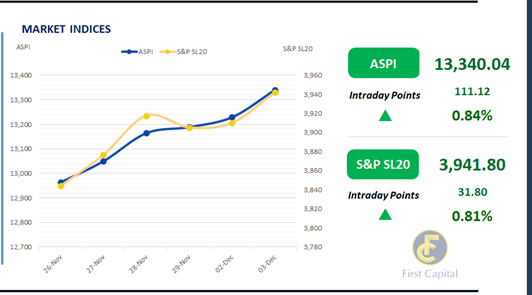

Amidst the increased participation from retail investors, ASPI closed the day in green at 13,340, gaining 111 points, marking a 0.84% increase from the previous day.

Additionally, specific stocks in the Food, Beverage and Tobacco sector and Plantation sector continued to attract investor interest throughout the day.

Participation in the Banking sector saw a decrease during the trading session. The most significant contributors towards the positive index were LOLC, CFIN, RCL, HNB, and DIPD.

Meanwhile, turnover stood at LKR 3.2Bn, marking a 10.0% decrease from the monthly average. Moreover, the Food, Beverage and Tobacco sector led the turnover by 24%, followed by the Capital Goods and Materials sectors jointly contributing 32% of the overall turnover.

Additionally, out of 6 off-board transactions, notable transaction was recorded in AGPL where 2.0% of the stake in AGPL was traded at LKR 9.0 per share through 4 off-board transactions. Foreign investors turned net buyers with a net inflow of LKR 85.3Mn signaling interest in internal investments.

Profit-taking persists as yield curve rises slightly

The Secondary market yield curves edged up slightly as investors opted to maintain a profit-taking stance for the 2nd consecutive day, continuing from the previous day amidst moderate trading volumes.

Trades were concentrated on the short to mid end of the curve as the previous day, where 01.05.27 traded at 10.20% and 01.10.27 traded at 10.32%. Towards the belly end of the curve, 15.02.28, 01.05.28, 01.07.28 and 15.12.28 traded at 10.50%, 10.60%, 10.65% and 10.70% respectively whilst 01.12.31 traded at 11.35%.

Notably, the overnight liquidity saw a slight decline compared to the previous day and stood at LKR 127.9Bn, whilst CBSL holdings of government securities remained steady at LKR 2,515.6Bn for the day.

Furthermore, in the forex market, the LKR continued to appreciate against the USD for the 4th consecutive session, closing at LKR 290.6 for the day, compared to the last session closed at LKR 290.7. Additionally, LKR continued to appreciate against other major currencies such as GBP, EUR, CNY and AUD as well.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..