Colombo Bourse closed in red for the 11th continuous session owing to the lingering uncertainties surrounding the political environment in the nation while failing to recover losses since the beginning of the previous week which collectively amounted to 642 points.

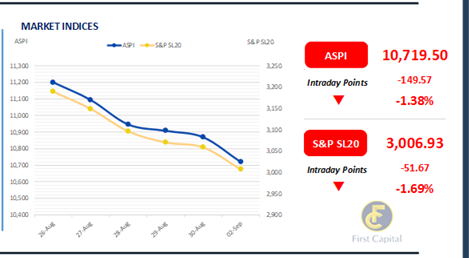

The ASPI experienced a continuous downtrend throughout the session, losing 150 points to close the day at 10,720. Amidst the escalated selling spree, COMB, LOLC, SAMP, HNB and JKH emerged as the top negative contributors to the index.

Turnover stood at LKR 615.8Mn, marking a 26.6% decrease from the monthly average standing at LKR 839.1Mn amidst improved participation of the retail investors.

The Capital Goods sector alone contributed 34% to the total market turnover, whilst Banking and Food, Beverage & Tobacco sectors jointly contributed 32% to the total turnover. Foreign investors turned net seller with a net outflow of LKR 21.9Mn.

Heightened uncertainty sparks selling pressure

The secondary market yield curve saw a slight uptick on the belly of the curve as selling pressure emerged on the mid tenors. Broadly, the sentiment during the day has been mixed with buying interest observed in short tenors.

However, selling pressure emerged on the mid tenors, predominantly on the 2028 maturity. On the short end of the curve, 01.06.2026 and 01.08.2026 enticed trades at 11.00% while 15.02.2026 closed at 11.15%.

On the 2027 maturities, 15.01.2027 and 15.12.2027 closed transactions at 11.10% and 12.00%, respectively. Amidst strong selling interest, 2028 maturities, 15.02.2028 recorded trades at 12.60% while 01.07.2028 inched up to 13.00% during the day.

Uncertainty continues to impact market sentiment, owing to concerns on the outcome of upcoming election. However, volumes improved to moderate levels amidst limited participation.

Meanwhile, CBSL has announced to raise LKR 152.0Bn at weekly T-Bill auction scheduled for 04th Sep-24. On the external side, LKR appreciated slightly against the USD, closing at LKR 299.6/USD while reflecting a similar appreciation against other major currencies as well.

Meanwhile, AWPLR closed at 9.13% as at end of August while remaining unchanged compared to the previous week.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..