The broader market recovered from 5 consecutive losses as slight buying interest emerged in the market during the day, with the majority of the sectors witnessing price gains across the board.

The ASPI started the day on a bullish note reaching an intraday high of 11,474 in the morning hours but retreated in the post-midday to close the day at 11,440, gaining 33 points with mixed participation.

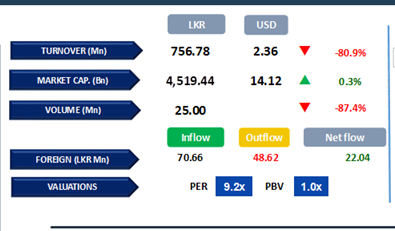

JKH, SAMP, MGT, BIL and LIOC emerged as the top positive contributors to the index. Meanwhile, turnover stood LKR 756.8Mn, marking a 25.0% decrease from the monthly average standing at LKR 1.0Bn where Capital Goods sector contributed 33% to the turnover, followed by the Consumer Durables and Diversified Financials sectors jointly contributing 34% to the overall turnover.

Furthermore, Apparel sector saw some buying interest today, highlighted by foreign buying in TJL through a crossing. Foreign investors turned net buyers, with a net inflow of LKR 22.0Mn.

Bond market remains dull amidst thin trading

The secondary bond market yield curve remained broadly stable, reflecting subdued activity and thin trading volumes across the market.

Among the traded maturities, 01.08.26 bond was traded at 10.52%, while the 2027 maturities including 01.05.27, 15.10.27, and 15.12.27 traded at 11.50%, 11.75%, and 11.80%, respectively.

Investor interest also extended to the 2028 maturities, with 15.02.28 and 15.03.28 bonds trading at 12.10% and 12.15%. On the longer end of the curve, 15.09.29 and 15.10.30 bonds were exchanged at 12.30% and 12.75%, respectively.

Moreover, in the forex market, the LKR remained stable against the USD settling at LKR 302.45. However, LKR marginally depreciated against other major currencies such as the AUD, GBP, and EUR.

Meanwhile, overnight liquidity for the day was recorded at LKR 72.5Bn while CBSL holdings remained steady at LKR 2,575.6Bn.

Despite a year-on-year increase in headline inflation to 2.4% in July 2024, up from 1.7% in June 2024, the rise in inflation was primarily driven by increases in both food and non-food categories.

Food inflation climbed to 1.5%, while non-food inflation rose to 2.8%. Despite these upward pressures on the headline figure, core inflation remained steady at 4.4%.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..