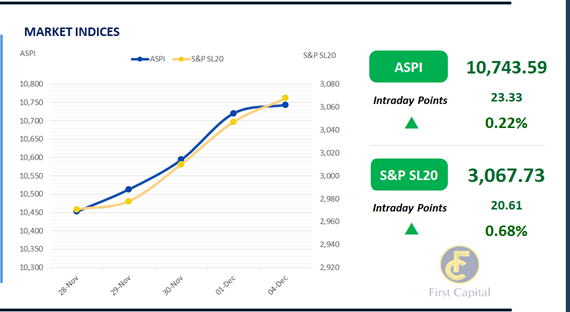

Bourse continues its form and ended in the green zone for the 4th consecutive session. Index started off very strong on the backs of banking counters such as SAMP and COMB, carrying the previous sessions confidence to today but slowly dropped throughout the rest of the day as investors chose to take profits on counters such as DFCC.

Nevertheless, the index ended with a 23 point increase to end on 10,744. Market turnover was recorded at LKR 708.4Mn, 34.0% lower than the average monthly turnover of LKR 1.1Bn. The Banking sector and the Food, Beverage & Tobacco sector were the largest contributors towards the market turnover with a joint contribution of 52%. Foreign investors turned to net sellers with a large selling on LLUB.

The secondary market on dreary grounds

The secondary market was rather on a stand still stance backed by ultra-thin volumes and limited activity during the day as investors chose to book profits. On a noteworthy observe selling interest was observed on 15.05.26 maturity which traded between 14.10%-14.15% whilst, 01.08.26 hovered between 13.95%-14.00%.

Moreover, towards the mid end of the curve, 01.05.27 and 15.09.27 maturities traded between 14.20%-14.30% whilst 01.07.28 maturity traded at 14.25%. Furthermore, notably the 3-month treasury bill witnessed buying interest with some considerable amount of volume which traded at 14.30%. on the external side LKR was broadly stable against the greenback recording at LKR 328.0.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..