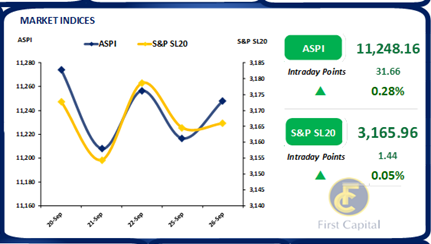

Colombo stock market bounced back during today’s proceedings and recorded an intraday gain of 32 points as investor sentiment boosted following S&P Global's upgrade of Sri Lanka's local currency rating from SD (selective default) to CCC+/C after the completion of domestic debt restructuring.

Accordingly, positive investor sentiment centered on index heavy weights and Banks. However, cautious level of investor activity was seen during the day as the overall buying interest in the market slightly toned down during the mid-day after the index reached an intraday high of 11,283.

Nonetheless, index managed to sustain the bullish optimism and closed for the day at 11,248. Retail investors showed interest on EDEN.N, given the ex-rights date falling on today. Furthermore, foreign participants continued to display buying interest on JKH for the second consecutive day, contributing to increased turnover, which reached LKR 943.0Mn, yet 38% below the monthly average of LKR 1.5Bn. While supporting the ASPI, the Capital Goods and Banking sectors continued to lead the turnover, jointly accounting for 60%.

Auction yields take a dip across the board

At the weekly T-Bill auction held today, total offered amount of LKR 50.0Bn was fully accepted with 03M and 06M tenors experiencing higher reception with an acceptance recorded above the total offered for the respective maturity.

Moreover, auction yields edged down registering a modest dip across the board. Accordingly, weighted average yield of 03M closed at 17.42% (-70bps) while 06M and 1Yr tenors budged down to 15.13% (-25bps) and 13.30% (-2bps), respectively. Meanwhile, in the secondary market, 01.06.26 maturity witnessed trades taking place in the range of 15.50%-15.60%, amidst mixed activities.

Furthermore, in the forex market, LKR depreciated marginally against the greenback and closed at LKR 324.6 at the end of the day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..