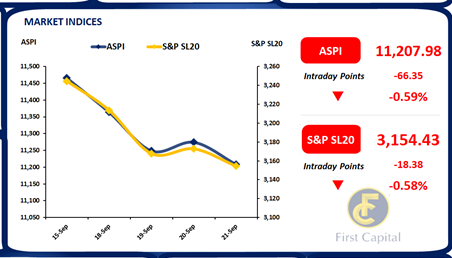

The Colombo bourse showcased a downward yet volatile trend during the morning session and continued to stumble down to halt in the red zone closing at 11,208 losing 66 points, on the back of the assumptions and uncertainties regarding a delay in obtaining the second tranche of IMF support due to the country not being able to achieve the total required commitments by the board.

Moreover, index heavy weights and Banking sector shares experienced a decline in prices influenced by the bearish market sentiment as the investor participation was considerably low. On the flip side, Retail shares and Utilities sector shares had improved interest during the day as they backed the index on a positive tone pushing the index higher despite the negative momentum.

Furthermore, investors chose to book profits on Primary dealer counters during the day resulted by the hike in the 06M bill which shot up by 19bps to settle at 15.38% speculating a possible upward revision on yields. Meanwhile the turnover was recorded at LKR 1.2Bn, 37% lower than the monthly average of LKR 1.9Bn contributed by the Capital Goods sector and Utilities sector for a joint contribution of 38%.

Yields slightly edge high; activities muted

The secondary market continued to observe toned down activities as market participants adopted a wait-and-see stance. However, despite limited activities and thin volumes secondary market yield curve slightly ticked higher with trades taking place on 01.05.2028 which hovered at 14.25%. Meanwhile, in the forex market, LKR depreciated marginally against the greenback and closed at LKR 324.7 at the end of the day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..