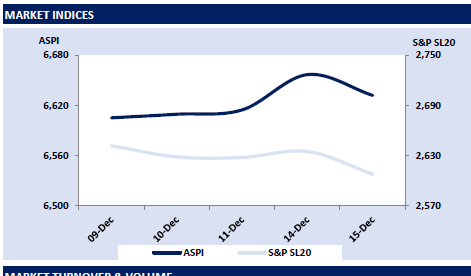

Longest winning streak experienced for the past 15 trading sessions was disrupted, reverting the direction of the market to negative.

Index witnessed a downtrend since the beginning of the session as it hit its intraday low of 6,626 during mid-day.

Later market experienced a short-lived bounce back and closed at 6,632 losing 25 points. Consumer services sector dominated the turnover for the session with a contribution of 34% aided by SHOT.

Market experienced 3-week continuous net foreign outflow while recording low participation.

Meanwhile in the bond market the long term yields edged slightly higher in thin trade. The secondary market witnessed slight selling interest during the day mainly centered on the long end of the yield curve although overall market recorded thin volumes.

In the short end of the yield curve, 15.12.22 maturity traded at 5.72% while in the long end, 15.10.27, 01.07.28 and 15.05.30 changed hands at 7.21%, 7.26% and 7.78% respectively.

Meanwhile, CBSL announced an issue of LKR 40.0Bn worth of T-bills through an auction on 16th Dec 2020.

First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..