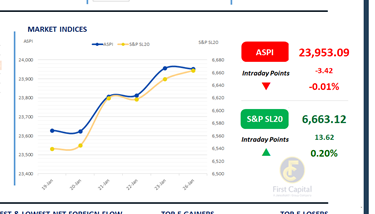

The Colombo Bourse displayed mixed sentiment during today’s trading session, with the ASPI edging down by 3 points to close at 23,953, while the S&P SL20 gained 14 points to end at 6,663.

Top negative contributors to the ASPI were SAMP, RICH, DFCC, CTHR and CARG. After a prolonged period, LOLC and Browns Group counters led market turnover, with LOLC contributing LKR 503.6Mn (9.2%) to total turnover, followed by BRWN at LKR 422.6Mn (7.7%).

Daily turnover stood at LKR 5.5Bn, marking a decrease of 10.1% over the monthly average of LKR 6.1Bn. Capital Goods sector led the daily turnover with a share of 29%, followed by the Diversified Financials, and Food Beverage & Tobacco sectors collectively contributing 27%. Foreign investors remained net sellers, posting a net outflow of LKR 25.0Bn.

BOND MARKET

Short-end selling and long-end buying shapes the yield curve dynamics

As the final week of January-2026 began, the secondary market registered limited trading activities with moderate trading volumes. Some short-tenor maturities depicted selling pressure, while some buying interest from foreign banks was observed towards the long-end of the curve.

In terms of trades, 01.05.2028 traded in the range of 9.14%-9.21% and 15.09.2029 traded in the range of 9.65%-9.67%. Over the long-term, 15.06.2035 maturities changed hands between 10.93%-10.98%.

Moreover, the PDMO announced an issue of LKR 205.0Bn worth of T-bonds through an auction on the 29th January 2026. At the auction, LKR 60.0Bn, LKR 80.0Bn and LKR 65.0Bn worth of T-bonds are to be issued under 01.03.2030, 15.06.2034 and 01.07.2037 maturities respectively.

On the external front, the LKR remained flat against the USD, closing at LKR 309.80/USD. Overnight liquidity in the banking system slightly expanded to LKR 169.74Bn from LKR 166.13Bn recorded previously.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..