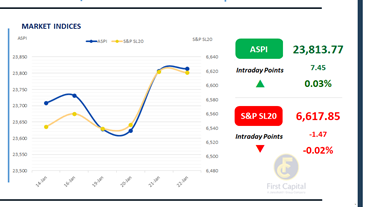

The Colombo Bourse showed mixed sentiment today, with some selling pressure following yesterday’s gains. ASPI moved up by 7 points, closing at 23,814.

S&P SL20 index slightly dipped by 1 point to 6,618. Top positive contributors for the ASPI were HNB, DFCC, UML, RICH and ASCO, while the impact of positive and negative contributors on overall market performance was broadly balanced.

Daily turnover stood at LKR 8.3Bn, which marks a 48.6% increase over the monthly average of LKR 5.6Bn. HNW participation was higher while retail investor sentiment maintained at an average level.

Capital Goods sector led the daily turnover by 25%, followed by the Food Beverage & Tobacco and Banking sectors collectively contributing 34%. Foreign investors remained net sellers, posting a net outflow of LKR 144.6Bn.

BOND MARKET

Secondary market sees mixed activity amid moderate volumes

The secondary market depicted moderate volumes with mixed activity, whereas the yields broadly held steady. Among the tenors traded today, in the 2028 segment, 15.02.2028, 15.03.2028, 01.05.2028 and 01.07.2028 traded within the range of 9.05%-9.15%.

Over 2029 segment, 15.06.2029, 15.09.2029, 15.10.2029 and 15.12.2029 changed hands in the range of 9.55%-9.67%. Moving ahead, both 01.03.2030 and 01.07.2030 maturities traded at 9.70%. Also, 15.03.2031 and 01.12.2031 were dealt at 9.95% and 10.00% respectively.

Moreover, 01.07.2032 traded at 10.45% and over the long-end, 15.06.2035 changed hands at 11.05%. On the external front, the LKR slightly appreciated against the USD, closing at LKR 309.68/USD compared to LKR 309.85/USD recorded the previous day. Overnight liquidity in the banking system contracted to LKR 157.54Bn from LKR 189.06Bn recorded previously.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..