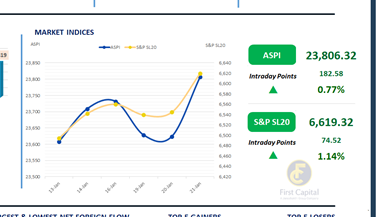

The Colombo Bourse moved up steadily during the day, supported by sustained buying interest throughout the session. ASPI moved toward an all-time high after gaining 183 points, closing at 23,806.

S&P SL20 index moved up by 75 points to an all-time high of 6,619. Top positive contributors for the ASPI were HAYL, DOCK, SAMP, VONE and SLTL.

Daily turnover stood at LKR 9.8Bn, which marks an 86.6% increase over the monthly average of LKR 5.3Bn. HNW investor interest were among Banking, Diversified Financials and Construction sector counters, while the broad market was keen on export-oriented companies following the recent LKR depreciation.

Capital Goods sector led the daily turnover by 44%, followed by the Banking, and Food Beverage & Tobacco sectors collectively contributing 28%. Foreign investors remained net sellers, posting a net outflow of LKR 51.1Bn.

BOND MARKET

Secondary market volumes hold steady whilst buying sentiment prevails

The secondary bond market continued to witness buying interest today, while overall activity remained steady at moderate levels. Among the tenors traded today, short end maturities including 01.05.2027 and 15.09.2027 changed hands within a yield range of 8.90% to 8.95%.

In the 2028 segment, the 01.05.2028 and 15.12.2028 bonds traded between 9.12% to 9.20%. Further along the curve, activity was also seen in the 2029 segment, with 15.06.2029, 15.10.2029, and 15.12.2029 maturities trading within a yield band of 9.57% to 9.65%.

Meanwhile, the 01.03.2030 maturity traded at 9.71%, while the 15.03.2031 maturity traded at 10.00%. On the longer end, the 01.06.2033 bond traded from 10.73% to 10.69%, and the 15.06.2035 bond traded from 11.07% to 11.03%.

The PDMO raised an aggregate LKR 112.5Bn at today’s T-Bill auction, below the initial LKR 125.0Bn on offer, while total bids received amounted to LKR 351.4Bn.

The 3M bill saw acceptances of LKR 40.0Bn, in line with the offered amount, with the weighted average yield easing 2bps to 7.93%. A total of LKR 65.0Bn was raised through the 6M bill, also matching the amount on offer, while the weighted average yield declined 8bps to 8.36%.

Meanwhile, the 12M bill recorded acceptances of just LKR 7.5Bn, falling short of the LKR 20.0Bn offered, as the yield edged down 1bp to 8.47%.

On the external front, the LKR depreciated against the USD, closing at LKR 309.85/USD compared to LKR 309.74/USD recorded the previous day. Overnight liquidity in the banking system contracted to LKR 189.06Bn from LKR 200.77Bn recorded previously.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..