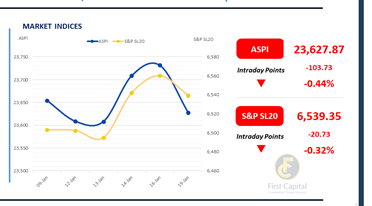

Colombo Bourse experienced a volatile day with an early rally, followed by a mid-day decline to a low, ending the day at negative territory. ASPI closed at 23,628 with a loss of around 104 points.

S&P SL20 index decreased by 21 points to close the day at 6,539. Top negative contributors for the ASPI were DOCK, COMB, NTB, SAMP and SPEN. Daily turnover stood at LKR 4.7Bn, representing a 5.0% decrease over the monthly average of LKR 4.9Bn.

Retail investors showed strong participation during the session, with notable interest in hotel sector stocks ahead of the upcoming earnings season.

Overall HNW participants were less active, with their focus primarily on construction sector counters. The Capital Goods sector was the major contributor to today’s turnover accounting 27% of the turnover, followed by the Materials and Banking sectors, which together contributed 29%. Foreign investors turned net sellers, posting a net outflow of LKR 697.9Bn.

BOND MARKET

The week begins with lower yields in the secondary market

As the week started, the secondary market depicted limited activity amidst moderate volumes. Trades mostly clustered towards the mid-end of the curve, however, some activity was observed towards the long end. Notably, yields drifted lower during the session.

Among the traded maturities, 15.03.2028 and 01.05.2028 were dealt at 9.10% and 9.15%. Over 2029 segment, 15.06.2029 was traded at 9.60%. Both 15.09.2029 and 15.10.2029 were traded at 9.65%, while 15.12.2029 changed hands at 9.67%. 01.03.2030 maturity was traded at 9.75%. 15.03.2031, 01.12.2031 and 01.06.2033 maturities changed hands at 10.10%, 10.20% and 10.73% respectively.

Moreover, over the long-end, 15.06.2035 was traded within the range of 11.15% to 11.10%. On the external front, the LKR depreciated against the USD, closing at LKR 309.7/USD compared to LKR 309.3/USD recorded the previous day. Overnight liquidity in the banking system expanded to LKR 196.08Bn from LKR 160.19Bn recorded previously.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..