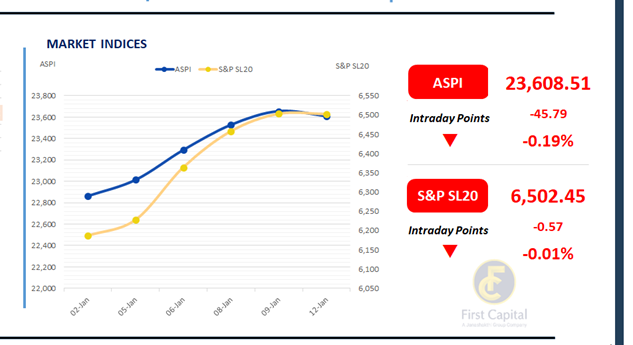

The Colombo Bourse turned bearish after 11 consecutive days of bull market. ASPI rose to an intraday high of around 23,841 early in the session but trended downward thereafter due to sustained selling pressure, before staging a mild late-session recovery to close at 23,609, dropping by 46 points (-0.19%), reflecting a cautious market sentiment.

S&P SL20 index moved down by nearly 1 point to close the day at 6,502. Index was weighed down by DOCK, RICH and CARG along with the declines in banking counters such as HNB and SAMP. Daily turnover was recorded at LKR 5.2Bn, representing an increase of approximately 14.7% above the monthly average level of LKR 4.5Bn.

HNW participation remained subdued, while retail activity was comparatively stronger. The Capital Goods counters contributed 24% of total turnover, while Banking and Food Beverage & Tobacco sectors together accounted for 31%. Foreign investors remained net sellers, posting a net outflow of LKR 35.4Bn.

BOND MARKET

The secondary market yields tick higher post T-bond auction

The week started with the first T-bond auction for 2026, where the yields edged up at the auction. Among the trades that executed prior to the auction, 15.03.2028 traded at 9.10% and 01.09.2028 traded at 9.22%. 15.09.2029, 15.10.2029 and 15.12.2029 maturities traded in the range of 9.61%-9.65%.

Additionally, over the mid-term, 15.05.2030 traded at 9.75%. At the T-bond auction, 2035 maturity was accepted at a higher rate, pushing up the yields. Thereby, 15.06.2035 changed hands at a higher range of 11.20%-11.18%. At the T-bond auction held today, PDMO raised a total of LKR 184.8Bn against an offered amount of LKR 205.0Bn, while the yields increased across all the maturities.

01.03.2030 and 01.06.2033 maturities were accepted in full, amounting to LKR 50.0Bn and LKR 40.0Bn, while the weighted average yields rose to 9.74% and 10.65% respectively. Acceptances on 15.06.2035 bond was LKR 54.8Bn, lower than its offer of LKR 75.0Bn, while the yield went up to 11.08%.

Moreover, 15.08.2039 maturity was also accepted in line with the offer of LKR 40.0Bn, inching up the yield to 11.09%. On the external front, the LKR appreciated against the USD, closing at LKR 309.38/USD compared to LKR 309.72/USD recorded the previous day. Overnight liquidity in the banking system contracted to LKR 168.9Bn from LKR 171.0Bn recorded previously.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..