The Colombo Bourse showed a positive trading session, with the market starting slightly weak but quickly stabilizing and moving higher as the day progressed.

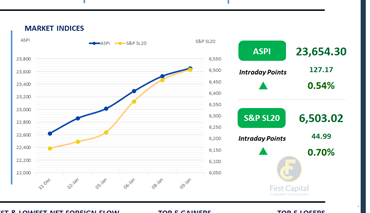

Price movements were orderly and low in volatility, indicating steady buying interest and improving investor confidence. The ASPI rose by 127 points to close at 23,654, while S&P SL20 index moved up by 45 points to close the day at 6,503.

Top positive contributors to the ASPI were JKH, COMB, VONE, CARS and NTB. Daily turnover recorded at LKR 8.5Bn, representing an increase of approximately 100% above the monthly average level of LKR 4.3Bn.

HNW participation was high during the day while 28% of the turnover came from crossings. Retail investors demonstrated moderate participation in trading. Investor interest in real estate sector counters continued, supporting trading activity within the sector.

The Diversified Financials counters contributed 25% of total turnover, while Food Beverage & Tobacco and Capital Goods sectors together accounted for 32%. Foreign investors remained net sellers, posting a net outflow of LKR 8.6Bn.

BOND MARKET

Muted investor activity results in flat yield curve

Investor interest moderated during the day, with subdued trading activity and lower volumes observed, resulting in the yield curve remaining broadly unchanged. Within the actively traded tenors, the 01.07.2028, 01.09.2028, and 15.10.2028 maturities traded at 9.20%.

In the 2029 segment, the 15.09.2029 and 15.10.2029 maturities were seen trading in the range of 9.60%-9.65%. Further along the curve, the 01.10.2032 maturity traded at 10.30%, while the long end saw the 01.11.2033 maturity trading at 10.55%.

On the external front, the LKR appreciated against the USD, closing at LKR 309.72/USD compared to LKR 310.14/USD recorded the previous day. Overnight liquidity in the banking system expanded to LKR 171.0Bn from LKR 168.5Bn recorded previously.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..