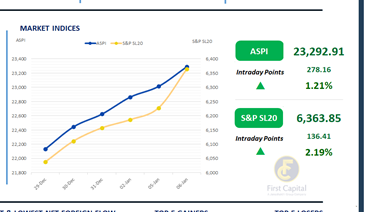

The previous bullish tone persisted in the Colombo Bourse yesterday as well, lifting the ASPI by 278 points to close the day at 23,293. The index exerted a steady upward momentum during the day, heavily weighing on the buying interest towards Banking sector counters.

Top positive contributors to the ASPI were HNB, COMB, JKH, NDB and SAMP. Both retail and HNW investors were highly active in today’s trading, with particular interest exhibited towards Banking and Poultry sector counters.

Meanwhile, Cables & conductors sector counters portrayed some selling pressure, as opposed to the previous buying. The market registered a daily turnover of LKR 6.6Bn, representing an increase of approximately 76% above the monthly average level of LKR 3.7Bn.

The Banking sector contributed 32% of total turnover, while Capital Goods and Food, Beverage & Tobacco sectors together accounted for 36%. Foreign investors turned net sellers, posting a net outflow of LKR 7.9Mn.

BOND MARKET

Low activity persists as short–mid yields edge up

The secondary bond market yield curve saw subdued trading volumes and low activity, while yields recorded a mild uptick across the short to mid tenor segments. Within the 2028 maturity bucket, the 15.03.2028, 01.05.2028, and 15.10.2028 bonds traded at the rates of 9.15%, 9.20%, and 9.26%, respectively.

The 15.12.2029 maturity changed hands at 9.71%. Further along the curve, the 15.05.2030, 01.07.2030, and 15.10.2030 maturities were traded at the rates of 9.76%, 9.80%, and 9.85%, respectively. Meanwhile, the 01.10.2032 and 15.06.2035 bonds, changed hands at yields of 10.35% and 10.76%, respectively.

On the external front, the LKR depreciated against the USD, closing at LKR 309.85/USD compared to LKR 309.75/USD recorded the previous day. Overnight liquidity in the banking system expanded to LKR 175.2Bn from LKR 135.8Bn recorded previously.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..