The Colombo bourse opened sharply higher, held its gains through a period of consolidation, and closed near the day’s highs, reflecting strong demand and a clearly bullish tone throughout the session.

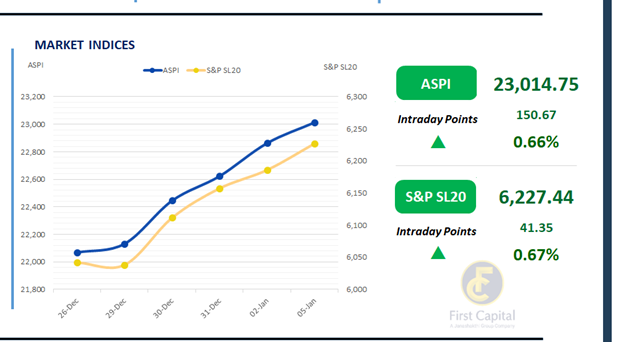

The All-Share Price Index rose by 151 points to close at 23,015, while the S&P SL20 index moved up by 41 points to close the day at 6,227. Top positive contributors to the ASPI were COMB, CARS, ACL, LOLC and SAMP.

Daily turnover recorded at LKR 5.8Bn, representing an increase of approximately 58% above the monthly average level of LKR 3.7Bn. Both HNW and Retail investors demonstrated strong participation and sustained interest in trading throughout the day.

Notable interest was observed in counters focused on cables & conductors as well as property sector stocks edged higher over the course of the day.

Meanwhile, dollar earning counters that stand to benefit from LKR depreciation, namely DIPD, HAYL, and HEXP attracted notable investor interest throughout the session.

The Capital Goods sector contributed 35% of total turnover, while Materials sector and the Banking sector together accounted for 25%. Foreign investors turned net buyers, posting a net inflow of LKR 87.9Mn.

BOND MARKET

The secondary market sees mixed sentiment, with mid-tenor trades in focus

The week began with mixed sentiment in the secondary market and trading activity concentrating towards the mid-term maturities. While the yields stayed stable across the yield curve, low trading volumes were observed during the session.

Among the traded maturities, 15.03.2028, 01.05.2028, 01.07.2028 and 15.10.2028 changed hands at 9.10%, 9.15%, 9.18% and 9.22% respectively. Moving along the curve, 15.06.2029 maturity traded at 9.60% and 01.07.2030 was dealt at 9.81%.

Moreover, 15.11.2033 traded higher at 10.50%. On the external front, the LKR depreciated against the USD, closing at LKR 309.75/USD compared to LKR 309.54/USD recorded the previous day. Overnight liquidity in the banking system slightly expanded to LKR 135.8Bn from LKR 134.5Bn recorded previously.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..