The Colombo market opened with a sharp upward movement and subsequently traded within a narrow range for most of the day, marked by minor fluctuations.

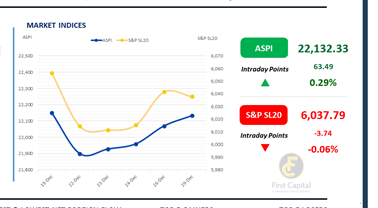

A total of 91 counters made positive contributions to the ASPI, while most counters recorded negative movements, resulting in mixed signals across the indices. ASPI increased by 63 points to close at 22,132 while S&PSL 20 ended in negative territory after moving slightly by 4 points to close at 6,038.

Top positive contributors to the ASPI were DOCK, HNB, RICH, DFCC and CCS. Daily turnover recorded at LKR 3.7Bn, which is about 7% above the monthly average level of LKR 3.5Bn.

Retail investors paid a special attention on DOCK and DOCK.R while HNW investors showed improved buying interest, gradually entering the market. Banking sector counters attracted renewed buying interest, while consumer services sector counters advanced following the strong post-crisis tourism arrival numbers recorded during the previous week.

The Capital Goods sector accounted for 33% of total turnover, while the Banking and Diversified Financials sectors contributed a combined 26%. Foreign investors turned net sellers, posting a net outflow of LKR 200.5Mn.

BOND MARKET

Modest selling pressure builds ahead of the T-bond auction

Preceding the T-bond auction tomorrow, the secondary market registered mild selling pressure. The yield curve rose approximately by 5-10bps as a result, particularly across the short to the belly end of the curve.

However, the volumes remained low during today’s session. As the trades were clustered towards the middle-end of the yield curve, 15.06.2029 maturity traded at 9.65%, both 15.09.2029 and 15.10.2029 traded at 9.70% while 15.12.2029 traded higher at 9.75%. Additionally, 01.07.2030 and 15.03.2031 maturities changed hands at 9.80% and 10.00%, respectively.

On the external front, the LKR remained flat against the USD at LKR 309.71/USD compared to the previous day. Overnight liquidity in the banking system marginally expanded to LKR 118.6Mn from LKR 111.7Mn recorded previously.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..