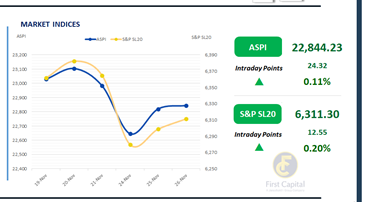

The Colombo Bourse carried forward yesterday’s positive momentum into the first half of today’s session amidst a bit of volatility, yet managed to close the day in green with the ASPI closing at 22,844, up 24 points, while the S&P SL20 advanced 13 points to close at 6,311.

Retail and HNW investors displayed moderate sentiment following today's monetary policy review, where policy rates were maintained. Notably, investors showed heightened interest in counters within the Hotel sector throughout the session.

The key market movers for the day were HNB, DOCK, DIMO, AEL, and PKME. Market turnover amounted to LKR 3.4Bn, which is 38% below the monthly average of LKR 5.6Bn. The Capital Goods sector accounted for 27% of total turnover, followed by the Materials and Banking sectors, which collectively contributed 29%. Foreign investors remained net sellers, posting a net outflow of LKR 124.6Mn.

BOND MARKET

Secondary market exerts a mixed tone with modest moves

The secondary bond market witnessed mixed sentiment, with some selling pressure observed within the short-end of the curve, alongside some bid-side strength.

However, market activity was limited with moderate volumes. At the short end of the curve 15.01.2028, 01.07.2028 and 15.10.2028 traded between 9.10% and 9.15%.

Forging ahead, 15.06.2029, 15.09.2029 and 15.12.2029 traded within the range of 9.49% and 9.55%. While there was some foreign buying on 01.07.2030, it changed hands between 9.65%-9.70%. Towards the long-end of the curve, 15.09.2034 traded at 10.62%, while 15.06.2035 traded at 10.69%.

The CBSL conducted its weekly T-Bill auction today, raising LKR 55.6Bn, falling short of the offered amount of LKR 86.5Bn. The 3M bill raised LKR 6.0Bn, falling short of its initial offer of LKR 16.0Bn, while the yield remained unchanged at 7.52%. The 6M bill raised LKR 42.7Bn, higher than its initial offer of LKR 40.0Bn, with the yield unchanged at 7.91%.

Meanwhile, the 12M bill raised LKR 6.9Bn, falling below its initial offer of LKR 30.5Bn, as the yield remained unchanged at 8.03%. On the external front, the LKR marginally depreciated against the USD, closing at LKR 307.91/USD compared to LKR 307.86/USD seen previously. Overnight liquidity in the banking system expanded to LKR 91.4Bn from LKR 79.3Bn recorded on the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..