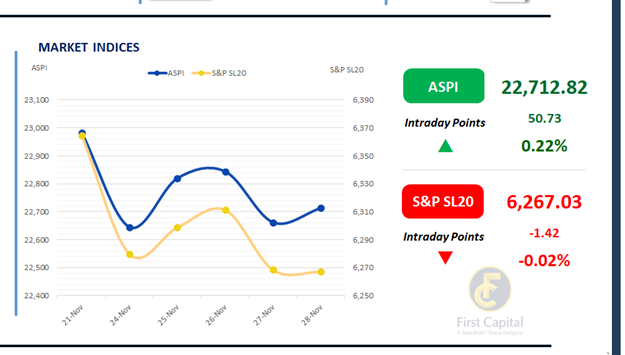

Despite an early halt in trading, the Colombo Bourse gathered fresh momentum and nudged its way upward. Following a brief downward movement in the beginning of the session, market regained traction with the ASPI advancing by 51 points to close at 22,713.

In contrast, the S&P SL20 edged down marginally by 1 point, ending the session at 6,267. Key positive contributors to today’s upward movement included BUKI, AEL, BIL, LOLC, and DOCK. Due to the shortened trading session, the market posted a lower turnover level of LKR 1.9Bn approximately 64.0% below the monthly average of LKR 5.4Bn.

The Capital Goods sector accounted for 35.4% of total turnover, followed by Banking and Telecommunication sectors, which collectively contributed 24.1%. Foreign investors remained net sellers, recording a net outflow of LKR 326.3 Mn, bringing the month-to-date net foreign outflow to LKR 3.7Bn.

BOND MARKET

Limited activity keeps the yield curve intact

The secondary market yield curve remained static amid the limited volumes. The 01.07.2030 maturity was amongst the few actively traded maturities, changing the hands at a rate of 9.57%.

On the external front, the LKR appreciated against the USD, closing at LKR 308.03/USD compared to LKR 308.08/USD seen previously. Overnight liquidity in the banking system marginally expanded to LKR 105.8Mn from LKR 92.3Mn recorded on the previous day.

Furthermore, the Sri Lanka Purchasing Managers’ Index for Construction (PMI – Construction) posted a value of 64.3 in Oct-25.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..