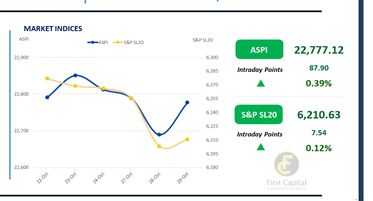

The Colombo Bourse rebounded from yesterday’s losses, with the ASPI closing at 22,777, marking an 88-point increase. Renewed investor interest was evident in WIND, following news of the company emerging as the lowest-cost bidder for Lot-1 of the Mullikulam wind power project.

Retail participation remained robust throughout the session, while HNW activity was relatively subdued. Off-board transactions were primarily observed on banking and blue-chip counters.

Key positive contributors to the index included WIND, SFCL, DIMO, NHL, and VLL. Market turnover stood at LKR 5.4Bn, approximately 28% lower than the monthly average of LKR 7.5Bn.

The Capital Goods sector dominated activity, accounting for 20% of total turnover, followed by the Utilities and Banking sectors, which together contributed 25%. Meanwhile, foreign investors continued to remain net sellers, recording a net outflow of LKR 372.5Mn for the day.

BOND MARKET

Volumes spike as buying activity amps up

The secondary bond market witnessed renewed buying interest across the yield curve, leading to a day of high trading volumes. At the short end of the curve, the 15.03.2028, 01.05.2028, 01.07.2028 and 01.09.2028 maturities traded within a yield band of 9.10%-9.25%.

Within the 2029 segment, bonds bearing maturities dated 15.06.2029, 15.10.2029 and 15.12.2029 traded within 9.55%-9.63%. Moving along the curve, the 01.07.2030 maturity traded at 9.75% while the 15.12.2032 maturity traded between 10.58%-10.45%.

Furthermore, the 01.11.2033 bond traded between 10.63%-10.57% and as the long end of the curve approaches, the 15.09.2034 maturity traded between 10.75%-10.70%. The CBSL conducted its weekly T-Bill auction today, fully accepting the offered amount of LKR 57.0Bn against total bids of LKR 100.6Bn.

The 3M bill raised LKR 2.8Bn, falling short of its initial offer of LKR 12.8Bn, while the yield remained unchanged at 7.52%. The 6M bill exceeded its initial offer of LKR 30.0Bn, raising LKR 37.2Bn, with the yield edging up by 1 bp to 7.90%.

Meanwhile, the 12M bill raised LKR 16.9Bn, surpassing its initial offer of LKR 15.0Bn, as the yield increased by 2 bps to 8.04%. On the external front, the LKR depreciated against the USD, closing at LKR 304.2/USD compared to LKR 304.0/USD seen previously. Overnight liquidity in the banking system expanded to LKR 154.8Bn from LKR 144.3Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..